Big-tech stocks like Apple, Amazon, Microsoft, Tesla, Netflix, Nvidia, and others have been under increased pressure since last Friday. This is directly related to Nasdaq’s press release to do a rebalancing of the Nasdaq-100 index to reduce the concentration of the weights, as Big-tech giant stocks have been rising in value at an accelerated rate since the beginning of the year, making the index overly concentrated.

The rebalancing date has been announced for 24 July, with the final weights to be published on 14 July. But shares of the largest companies in the index are losing value because speculators are working ahead of the curve. They are selling stocks that will lose weight because, after the official rebalancing, many funds following the Nasdaq-100 will sell those stocks to maintain a peg to the benchmark.

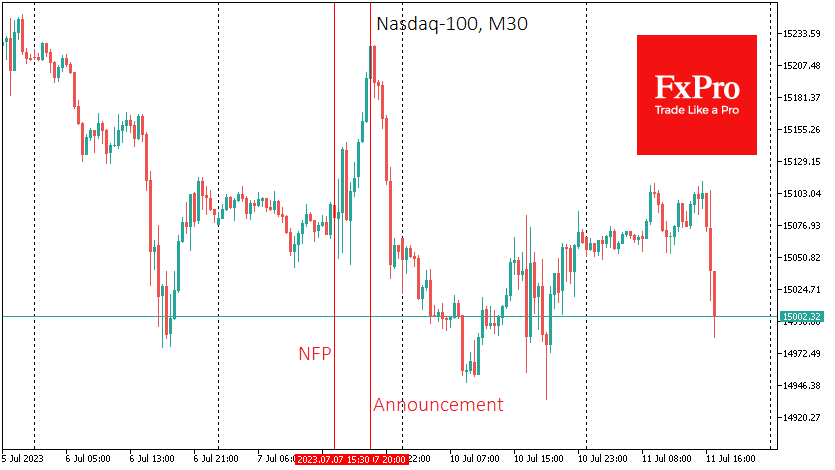

However, the above driver is not the only one for the stock market at all. In addition, traders also consider the growing chances of Fed rate hikes. On Wednesday, they have to deal with fresh US inflation data, which can also influence Fed policy and investor sentiment.

The FxPro Analyst Team