Mortgage Debt Time Bomb That Could Explode in July

April 08, 2020 @ 13:01 +03:00

Coronavirus has created the sharpest drop-off in employment rates the U.S. has ever seen. Those job losses are now translating into a shocking rate of unpaid mortgages that are about to come crashing down.

Under the federal government’s coronavirus relief package, homeowners can put off their mortgage payments for up to three months. Data from the Mortgage Bankers Association show that the number of people taking advantage of the program is growing at an alarming rate.

In just a month, the percentage of loans in forbearance went from 0.25% to 2.66%. The forbearance program is intended to help Americans make ends meet as COVID-19 puts the entire economy on pause. But some parts of the economy aren’t on pause—they’re on an indefinite vacation.

That’s because even if coronavirus outbreaks are contained in the coming weeks, the public will likely carry on with social distancing measures. Ex-FDA commissioner Scott Gottlieb said the lasting fallout from coronavirus will cripple a wide range of industries from aviation to hospitality.

That means the layoffs that have ripped through the labor force aren’t temporary—those people will probably remain unemployed once lockdown measures have been lifted. The government’s forbearance program allows them to postpone their mortgage payments, but not indefinitely.

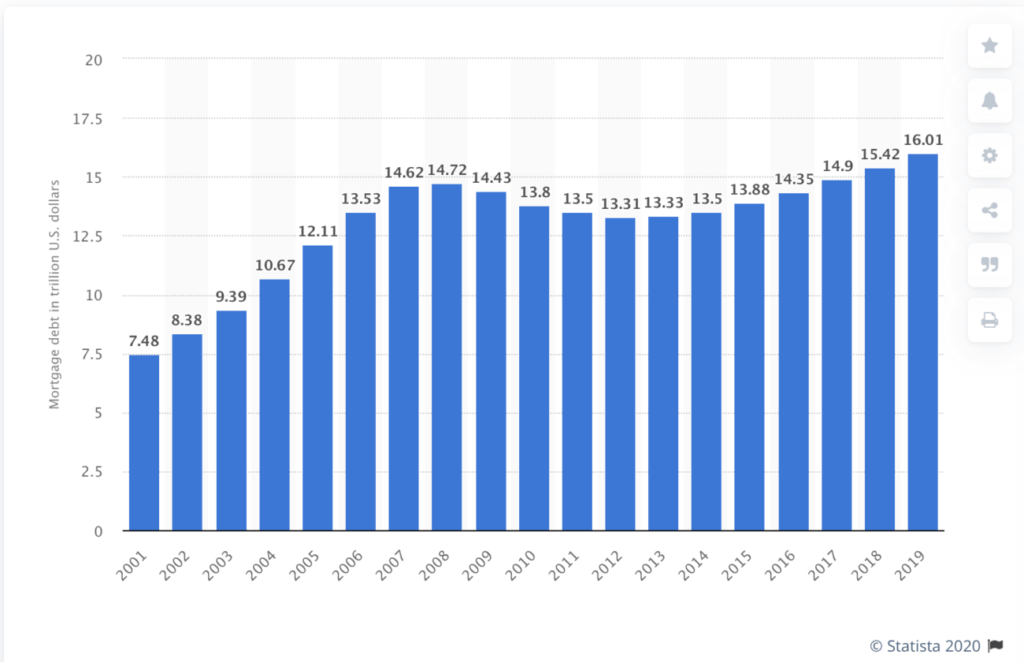

Americans are currently sitting atop $16 trillion worth of mortgage debt, The MBA data suggests that $416 billion of that has been pushed off into a crippling lump sum payment due in July.

If a large percentage of the servicing book — let’s say 20-30% of clients you take care of — don’t have the ability to make a payment for six months, most servicers will not have the capital needed to cover those payments.

That’s going to be a costly debt bubble. Bloomberg data show that Ginnie Mae guaranteed $583 billion worth of mortgages to that demographic in just the past two years. MBA data show that 4.25% of Ginnie Mae’s loans have gone into forbearance—that’s a $25 billion debt bomb waiting to explode.

This doomsday scenario assumes the number of forbearances doesn’t continue rising. But Mark Zandi of Moody’s is expect those figures to go up exponentially. He sees as many as 30% of homeowners defaulting this year, which translates into as much as $4.8 trillion in deferred mortgage debt.

Coronavirus Stimulus Fueled a Mortgage Debt Time Bomb That Could Explode in July, CCN, Apr 8