Oil is up 2.8% since the start of the day on Friday following a new round of escalation in the Middle East. The price of Brent rose above $80, while a barrel of WTI traded above $75. The US and the UK carried out strikes on military targets in Yemen, which has vowed not to let the attacks go unanswered. The potential for a chain reaction is alarming, promising severe logistical problems in a major shipping artery that accounts for 15% of the world’s trade. And that’s not to mention the risks to global oil supplies from a region that accounts for a third of the world’s supply.

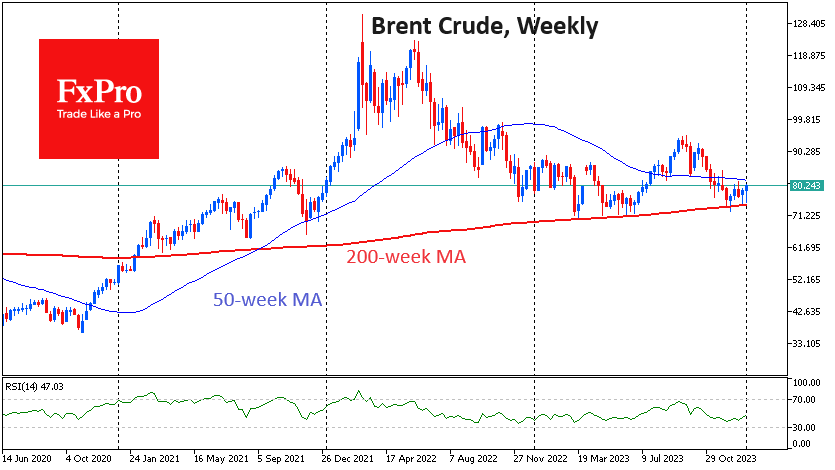

The geopolitical escalation in the Middle East came during another test of a key price level. Throughout 2023, oil fell sharply on signs of weak demand from a slowing China and a sluggish Europe. But each time, the downside was halted at the 200-week moving average for Brent and WTI. OPEC+ production quota cuts or a new round of escalation have often halted the sell-off in oil. The beginning of January has so far continued last year’s pattern, with no chance of the price falling below the average level of the last four years.

We can say that Russia and the Middle East are trying to outline the price floor. A technical confirmation of the change in trend could be a rise above the previous local highs of late December of $81.5 for Brent and $76.5 for WTI.

Other technical factors could also come into play. Brent was above its 50-day average intraday on Friday, and previous highs are close to the 200-day average, the crossing of which very often reinforces a breakout move. And in our case, it could be a quick rise towards $85 or even $92 a barrel for Brent.

For WTI, this bullish scenario opens up an easy path to the $80s and on to $86.

On the other hand, the fact that oil and gas have ignored geopolitics for so long and have not retreated from crucial support levels suggests that there are significant domestic pressures. We cannot completely rule out a scenario in which the sworn friends within OPEC return to fighting for market share that is being methodically taken away by other countries, led by the US.

The FxPro Analyst Team