Midday EURUSD roundup

August 23, 2018 @ 16:26 +03:00

USD could not keep its upward impulse of this morning. During the day DXY fell from 95.4 level at one point to 95.10. Decreasing to 95, the former strong resistance, which now becomes a support, seems to be a good opportunity to buy on dips for dollar bulls. The EURUSD is trading close to 1.1560, lower than on the start of the day at around 1.1600.

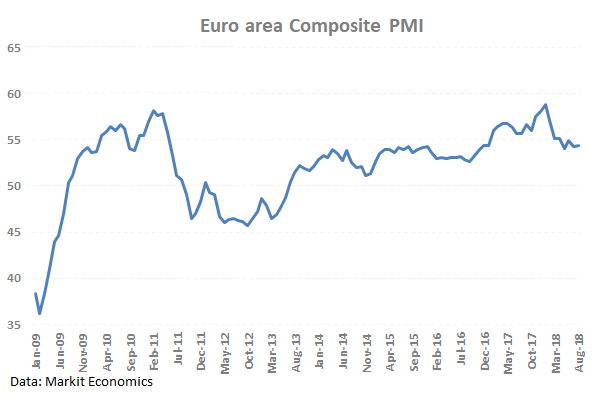

Bullish: The lowering of the peripheral euro zone bonds yields. The increase of PMI numbers, according to flash August estimates.

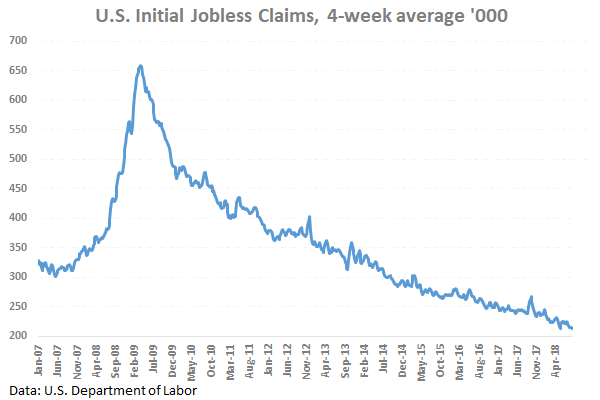

Bearish: Falling chances for Wiedmann (hawk in ECB) to become the president of the Central Bank next year. Another portion of strong labour data in the US on weekly unemployment claims. Hawkish FOMC minutes.

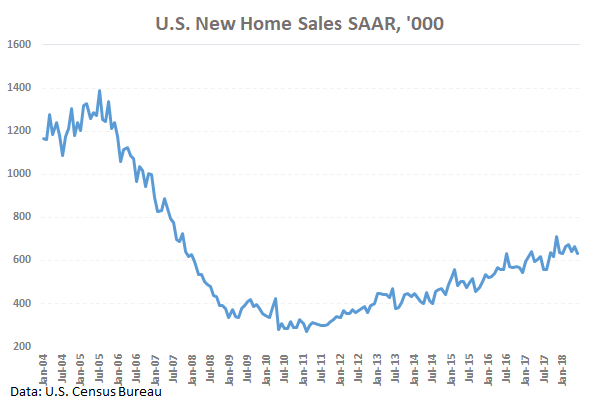

Next focus on: U.S. New Home Sales at 13:00 GMT.