Markets are quiet in anticipation of the Fed’s comments later today. The most popular currencies and equity indices have stabilised near important levels near the limits of their trading ranges, from where they are equally likely to step back into established trends or break them.

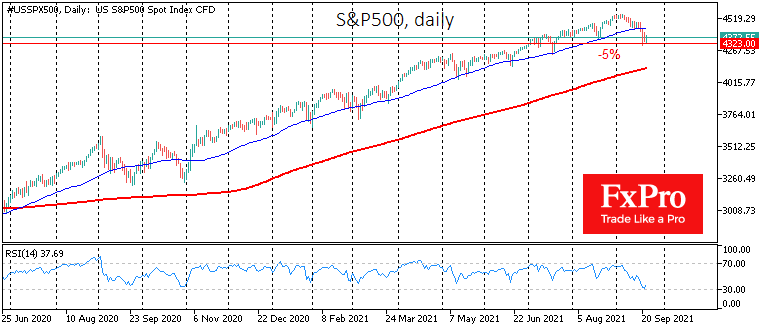

The S&P500, the benchmark stock index, has found some support from buyers after it fell 5% from the early September peaks, but so far, it has not found enough support from buyers to develop growth ahead of the Fed statement and press conference. A renewal of the week’s lows would pave the way for a deeper, 10% correction near 4100 on the S&P500, near which the major 200-day moving average also runs. Soft comments from the Fed could bring back active buying in shares and push indices to new all-time highs as early as next month.

EURUSD, the FX flagship pair, has settled near 1.1700, a support area from last July. It has traded lower for only a few days and was quick to find buyers. With hawkish FOMC comments, a dip below this level would occur, highlighting the contrast in policy between the Fed and the ECB. In that case, the EURUSD may correct towards 1.1200 before the end of the year. The Fed’s dovishness may push the pair towards the upper end of the range above 1.21 by the end of 2021.

The precious metals have been resisting the general consolidation trend in recent days. After last week’s tumultuous dip, cautious buying remains in place. Gold is again near $1780, staying away from significant technical levels to highlight and reinforce the bullish sentiment. Silver is hitting the downside to the former lower band trading channel of the last year, and it cannot move back above $23 just yet. Fed softer comments will spur demand for metals, as overall demand risk.

By the Fed’s soft stance, we mean the desire to get more data before announcing a reduction in the asset purchase programme on the balance sheet. This is the most likely scenario due to Chinese uncertainty (has Evergrande triggered a domino effect?) and the latest weak labour market report. However, if the Fed emphasises that the current stimulus has outlived its usefulness and is introducing adverse secondary effects, a deeper correction and reassessment of risks could begin in the markets.

The FxPro Analyst Team