Markets set up for disappointment from Fed meeting as bond yields renew rise

March 15, 2021 @ 11:20 +03:00

All eyes will be on the Federal Reserve’s meeting next week as traders put pressure on the central bank to prevent a de-stabilizing rise in bond yields. Yet the U.S. central bank is likely to stick to its messaging that higher yields reflect the rosier economic outlook, suggesting the clash between recalcitrant bond traders and a patient central bank will continue.

The central bank’s unwillingness to push back against the bond market’s speculation has ended up sapping investor sentiment, with the sharp rise in long-term bond yields this year causing momentary panic across technology stocks, corporate bonds and emerging markets. Some of these market nerves reflect worries that a further disorderly increase in long-term yields could hamstring a recovering and highly leveraged economy, ill-prepared to deal with a rise in borrowing costs.

The 10-year U.S. Treasury note yield rose to around a one-year high of 1.63% at the end of the week, The benchmark maturity is up around 70 basis points where it traded at the start of 2021. Meanwhile, the S&P 500 SPX, +0.10% and Dow DJIA, +0.90% finished at another record on Friday, after rebounding from last week’s slump when investors were rattled by the prospect of further selling in the bond market.

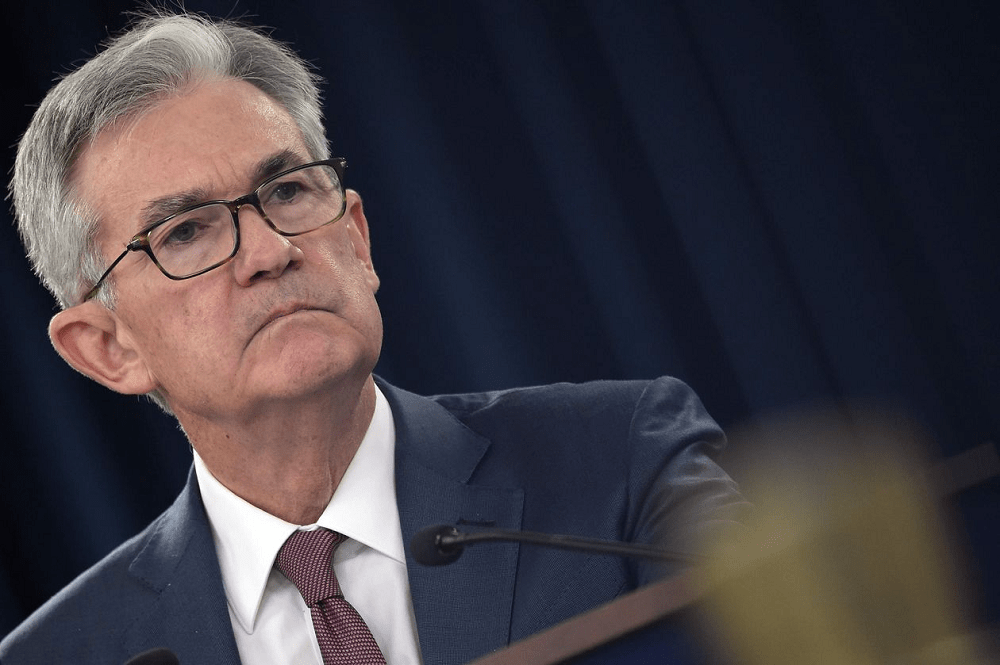

Analysts anticipate Fed Chairman Jerome Powell will repeat the mantra that the central bank remains far away from reaching its employment and inflation goals at his press conference after the policy meeting on March 17. Perhaps more pertinently, the Fed is unlikely to meet the calls of bond traders to announce tweaks to the Supplementary Leverage Ratio, which was adjusted last year to help banks deal with the coronavirus crisis, or to change the composition of its monthly purchases of U.S. Treasurys and mortgage bonds.

With a $1.9 trillion stimulus bill now signed into law by President Joe Biden, some senior Fed officials may choose to move their expected timeline for the first interest rate hike since the pandemic began into 2023. But such a move still remains far away from the market’s more hawkish expectations, with short-term money markets penciling in a rate increase as early as the end of 2022.

“It creates a discrepancy what the Fed is projecting and the markets are projecting,” said Lauren Goodwin, economist and portfolio strategist at New York Life Investments, told MarketWatch. Yet it’s unclear if this tension has the potential to drive further market turbulence in the way it has in the past few weeks, according to Jefferies’ Aneta Markowska. She argued the bond market’s dizzying selloff so far had reached levels that indicated investors had already digested the economic boost from the stimulus bill. Until the Fed started the conversation on tapering its asset purchases, she didn’t see yields moving higher.

In the end, the heated debate on where interest rates are headed may turn out to be a sideshow for stock-market investors momentarily dazed by the rise in long-term bond yields.

Markets set up for disappointment from Fed meeting as bond yields renew rise, MarketWatch, Mar 15