Markets set for years of rock-bottom rates with new Fed framework

August 27, 2020 @ 14:30 +03:00

On Thursday, the focus of the financial world will be on Fed Chairman Powell’s speech at Jackson Hole announcing a review of the monetary policy framework.

The Fed’s annual symposium is often used as a stage for announcing changes in monetary policy. Among some of the most important announcements were hints of QE in 2010 followed by the GFC and taper plan announcement several years later.

This time Jerome Powell will hold online broadcast today titled ‘Monetary Policy Framework Review’.

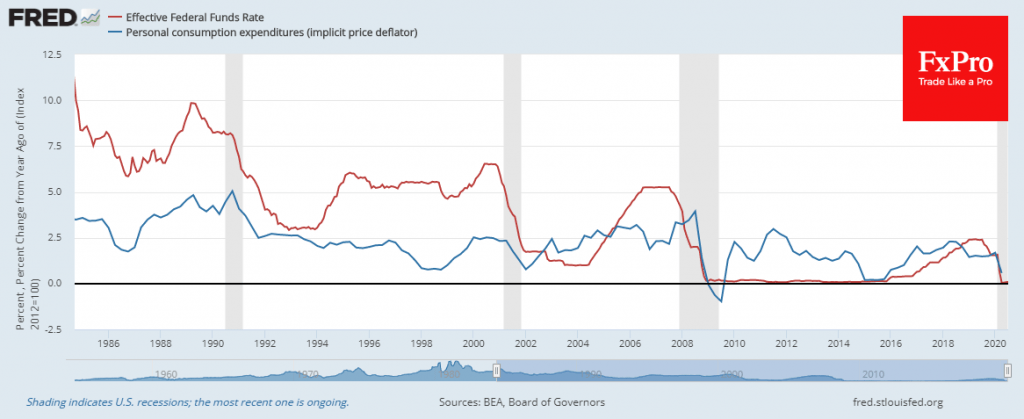

Since the 1970s, the Fed has had a dual mandate: maintaining price stability and maximum employment. The first can be interpreted very broadly, so the inflation target of 2% in the medium term has recently been mentioned.

However, should prices stay below the target for a long time, it has no impact on the Central Bank. After a steady return to target (actual or forecasted), the Central Bank returns to tightening. For example, the Fed started raising rates at the end of 2014, when the Core-PCE deflator was barely above 1%.

A change in approach will make the Fed softer, as market participants will not only wait for price growth to return to target, but also to compensate the accumulated lag created by the recession.

This will be a positive signal to the stock markets and bad for the Dollar. Some estimates suggest that in the event of such a shift, the Fed will not raise rates in the next five years.

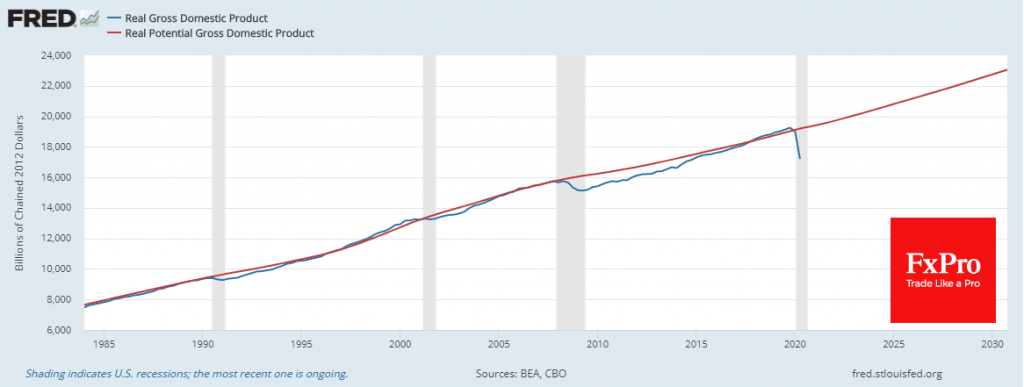

Another approach suggests a shift towards targeting GDP growth. As is the case with inflation, the Fed can press the monetary easing pedal as long as the economy falls behind trend levels. This shift also promises low rates for longer.

In his upcoming speech today, Powell should also look at the assessment of the current state of the economy. The latest FOMC meeting minutes showed considerable uncertainty.

However, the housing market, retail sales and Durable Goods Orders data showed a strong recovery on the way, which should increase Fed confidence in the economy. Both of these factors are good for markets, but we will have to find out what part of this optimism bidders have already put into price quotes. Is there any room left for new stock purchases?

The FxPro Analyst Team