Financial markets are clinging to positivity on Monday morning after a modest rise on Friday. Robust US labour market data reinforced expectations that the Fed will press the monetary policy brake harder. However, this news is countered by optimism that a strong labour market will allow the economy to avoid a recession by providing a soft landing. Furthermore, buyers’ interest is supported by China’s confirmation of cooperation in the audit of local companies according to US regulations.

April has been described as a historically favourable month for equity markets, so the warning signals from outside are so far dissipating into buying streams after the correction at the end of last week.

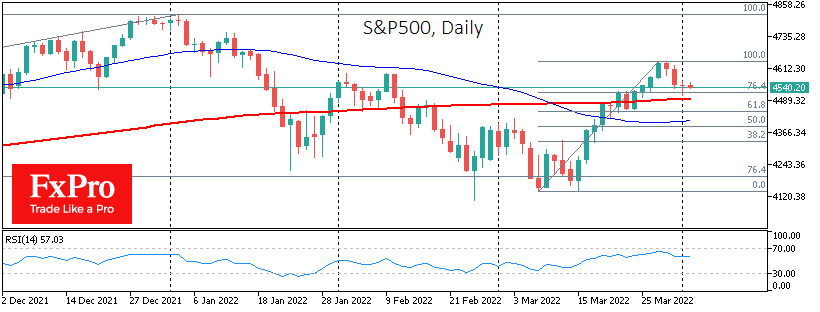

Against the market at the end of March, there was profit-taking activity after the more than 11% growth for S&P500 and an even sharper recovery for European and Asian indices from the March lows. The resurgence of positive sentiment among participants is setting up that buying near the close of trading on Friday and early on Monday is a sign of the end of the mini correction, which will be followed in the coming days by a renewal of the late March highs.

However, there are serious doubts about the market’s ability to sustain the positive momentum in a broader context.

Fed officials say they are considering a 50-point rate hike at the start of May and kick-starting the selling of securities off the balance sheet. The Fed raised the interest rate by 50 points in one meeting in May 2000, cementing the dot-com bubble’s melting down for the next three years.

Regarding China and the US, we should also be under no illusions. Over the last four years, we have seen many periods of truce, but the general trend towards more confrontation has continued, albeit along a somewhat winding road.

An essential ally of the stock market is a strong economy. Investors are shifting capital from bonds to equities as a growing economy makes it possible to count on rising corporate earnings.

However, this could prove to be a death trap for bulls. By buying now, they are pushing up equity indices, signalling to the Fed that markets are ready for a tightening. Historically, central banks in similar circumstances have tightened policy until markets are stressed, and economies are on the verge of recession.

The FxPro Analyst Team