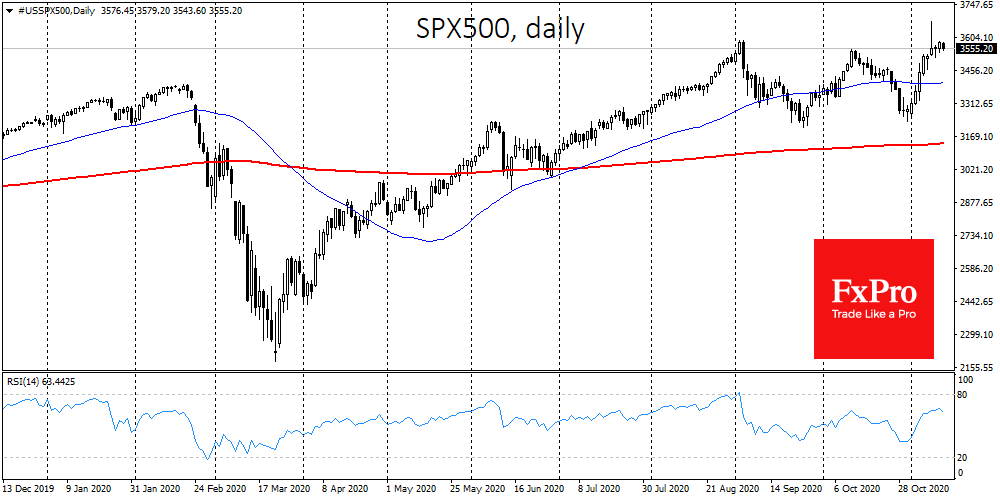

The vaccine rally at the beginning of the week is showing more and more signs of exhaustion. The S&P 500 closed on Wednesday near its historic highs, but futures on the index on Thursday morning gave up the gains of the day before. Similarly, the Dow Jones pressured after touching all-time highs. The trend of selling at highs prevents stock indices from increasing growth.

The dynamics of Pfizer shares are indicative: On Monday, the price exceeded $41, making highs since mid-2019. However, by the end of trading, it had already returned to $38.4, the upper limit of the trading range since May. So as we can see, the markets have levelled out the importance of a breakthrough in vaccine development.

The markets reacted on Monday as if the coronavirus trend was over; however, further market dynamics make it seem that this is far from the case. Markets are experiencing altitude sickness at the peaks, as was the case earlier this year.

Dow Jones 30 and S&P 500, we see the same symptoms approaching the levels of 30,000 and 3600. Nasdaq 100 got its weakness near 12,000 and the German DAX30 at levels above 13,000, an important resistance area this year.

The foreign exchange market has been reacting all week to the risks of new restrictions, first by ignoring the optimism and now by the partial fixing of gains in stocks.

The euro was under pressure, which is unexpected when one assumes a general increase in demand for risk assets and hopes for an accelerated economic recovery. But this can easily be explained by the fact that politicians in the region are more inclined to impose restrictions to bring down the wave of infections. Under these circumstances, the euro found it challenging to develop growth, which caused EURUSD to drop from an area above 1.1900, where the pair was on Monday, to 1.1760.

The strengthening of the dollar yesterday shifted to the pound and the renminbi. However, today we see a much broader growth of the US dollar in the foreign exchange market, pulling down the New Zealand dollar from 19-month highs at 0.69 and the Australian dollar from levels above 0.73.

It seems that analysts rushed into dismissing the dollar and celebrating the victory for stock markets from Biden’s win. But, it may turn out that a more cautious approach by the new administration, combined with a long transition period, will make life more difficult for markets, slowing down incentives and increasing the traction of the dollar.

The FxPro Analyst Team