Market sell-off to last until US support package

March 05, 2021 @ 11:44 +03:00

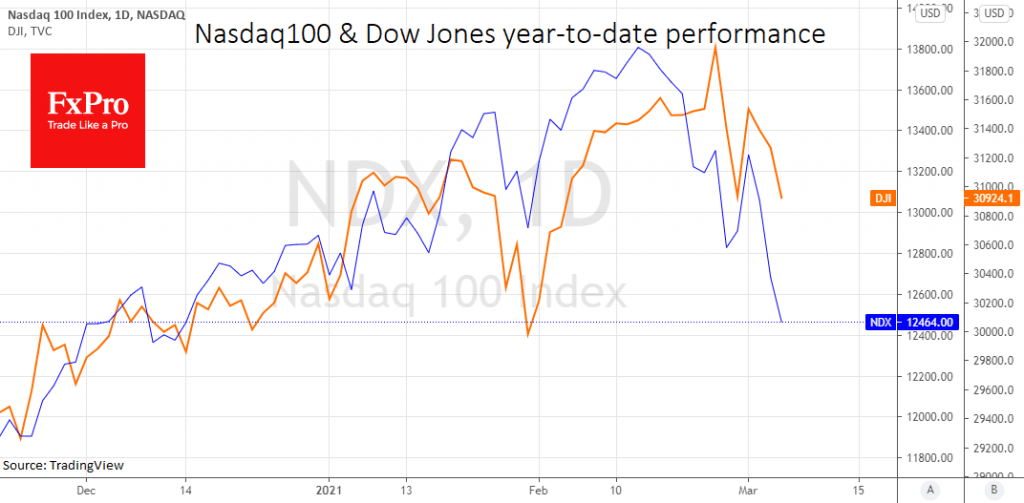

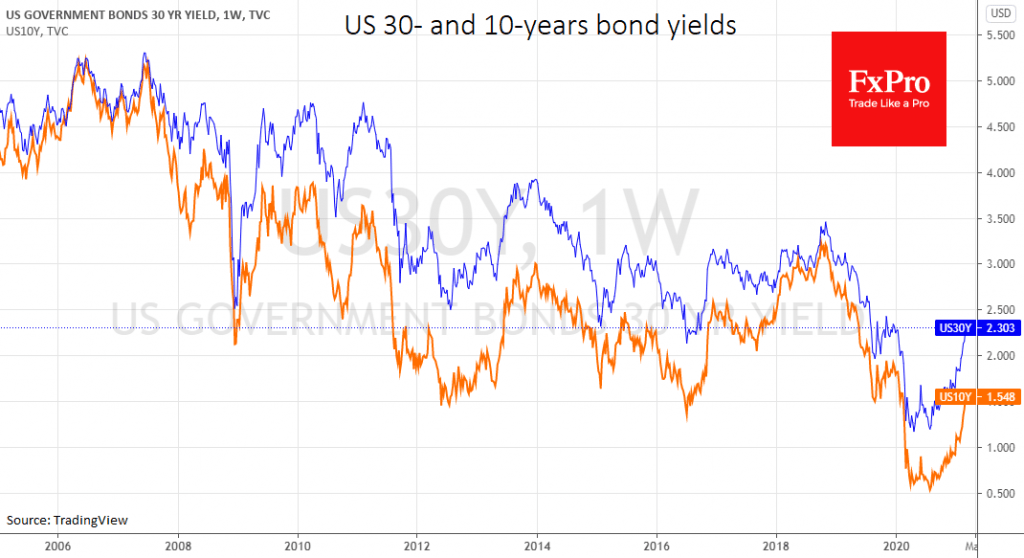

Yesterday was another day of falls with Nasdaq down more than 2% and much more modest losses for the Dow Jones (-1.1%) and S&P500 (-1.3%) as US long-term government bond yields continue to climb. Yields on 10-years rose to 1.57% and settled near 12 months highs, while the 30-years yield stands at 2.32%, near peaks since early 2020.

Investors had some hopes that Fed’s Powell would make assurances to get yields under some control. However, they have not heard this, adding to the pressure on markets. We have repeatedly pointed out that markets are unlikely to be satisfied with the Fed’s status quo given the impending massive stimulus package and its consequences.

Much of what is happening in the market right now is preparation by the big players for a new wave of US government bond auctions. Most likely, the Treasury will place longer-dated bonds to spread the debt burden. The expected increase in the supply of these securities reduces the price of all issued bonds.

However, it is essential to note that what is happening can hardly be called a sell-off of US government debt. During the sovereign debt crisis in the Eurozone, fear of default by Greece, Spain and Italy caused bond yields in the region to rise simultaneously with a substantial weakening of the Euro.

By contrast, though, the dollar is now adding against most of its rivals. In our opinion, it would not be correct to describe this movement as investors becoming attracted by higher yields of US debt. It is more likely that the big players are accumulating dollar liquidity to buy long-term US bond issues soon. We are now witnessing the market almost holding its breath, with an exhale sure to follow.

In the coming months or even weeks, a weakening of the dollar could commence, which was also the case after the first 2trn support package in the middle of last year.

The actions of the Fed could also disrupt the natural course of events. The next FOMC meeting is scheduled for the 17th of March. If the markets deteriorate steadily, it could force the committee to soften its rhetoric by turning to control the government bond yield curve.

The willingness to step up and keep yields under control has already been announced by the ECB and Bank of Japan, laying the foundation for a similar move from the Fed. This could be a turning point for the markets by quickly bringing buyers back into equities and commodities. However, the big question is whether the Fed will take this step before the Treasury makes all necessary bond placements. It seems that the Fed is trying to maintain faith in the dollar as the leading reserve currency.

The FxPro Analyst Team