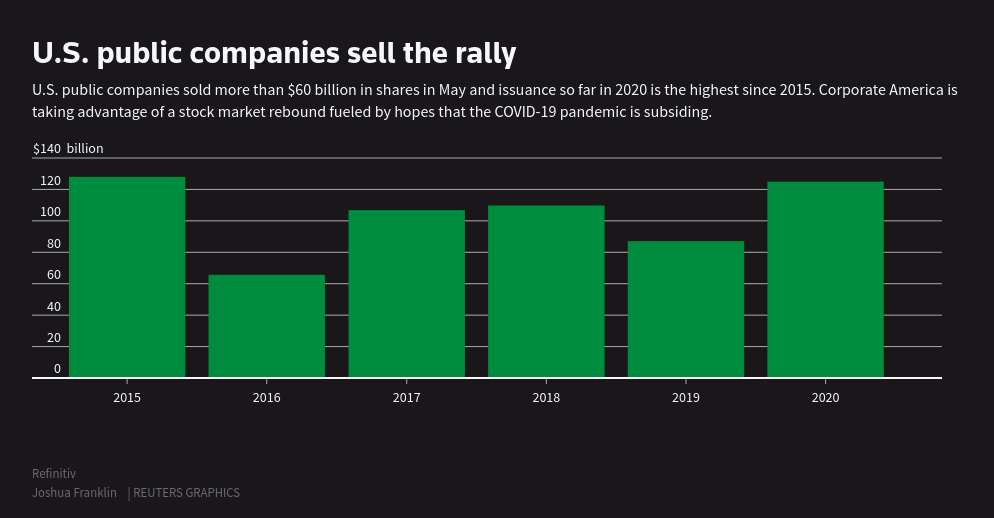

Global markets are growing, and companies are trying to seize this opportunity to raise capital. US public companies have sold new shares for $60 billion in May. The share issue for more than $120 billion so far this year is already comparable with this period in 2015. If the markets manage to avoid turbulence, we can expect companies to increase their share sales further. Companies are even more actively raising money through debt markets, attracting more than $1 trillion so far this year.

The new capital often raised by healthcare sector companies, driven both by market attention to the industry in general and by increased competition in it. In most cases, it is a race in which the winner takes it all.

The fundraising increases market capitalization, but somewhat restrains the growth of indices. This partially explains why the improvement of the epidemic situation resulted in a triple, smoother index growth compared to April.

Still, there are many more reasons to believe that demand for risks on the markets is limited, and the saturation point is very close.

Companies are increasingly reducing or cancelling dividend payments. A decrease in the share buybacks by IT companies is probably next in line. The share buyback is an essential driver of their price growth. However, the probable two-digit rate of GDP drop in the second quarter is likely to force companies to save capital rather than return it to investors.

The central banks became almost the largest buyers of assets in the markets at the moment. For example, the Bank of Japan bought up about 80% of local ETFs. The Fed bought $2.8 trillion worth of securities in less than three months. But there is a limit to these purchases, as we can hardly expect central banks to be the only holders of private assets.

Last week the Fed’s balance sheet rose by $60 bln against $103 bln and $213 bln in the previous two weeks. The launch of the new program in early May started with big purchases, but now it is losing momentum. Together with this, the market is also likely to lose strength, causing slippage of the stock indices.

The FxPro Analyst Team