Despite attempts at rebounding equity markets, moderate pressure on gold has persisted for the third consecutive trading session. This pressure is directly linked to rising long-term bond yields on US debt and several other developed countries.

Bonds and gold work like communicating vessels: rising real long-term yields draw capital to the debt markets away from gold. Over the last two years, the inverse correlation between gold and US 10-year Treasury yields has been very strong: gold prices peaked in August 2020, while yields rose from 0.5%.

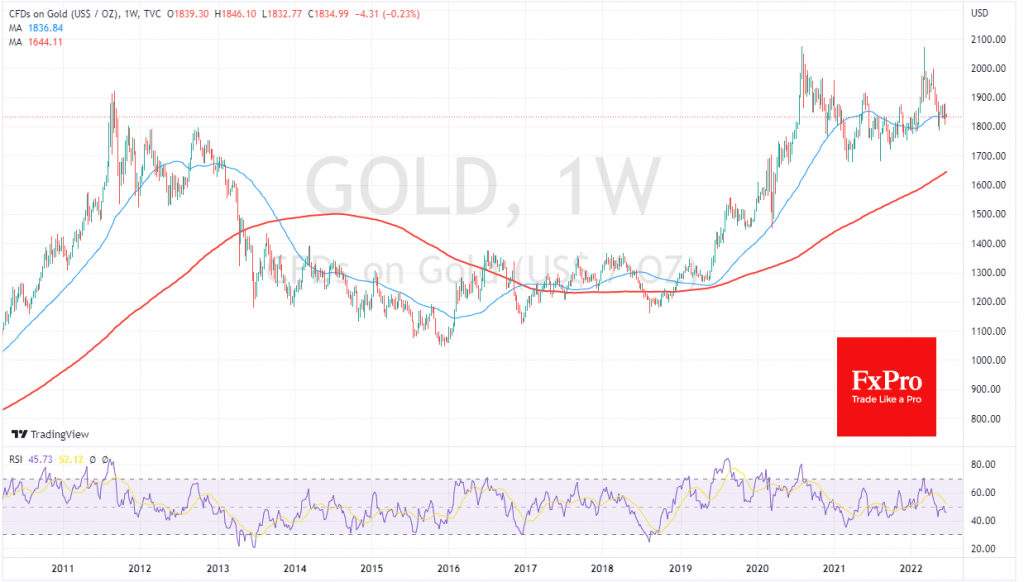

Last week, when the 10-year Treasury yield was rising temporarily to 3.5%, it tested the $1800 area.

However, there are several essential points to understand in this correlation.

First, the 10-year Treasury yields touched 11-year highs last week, while gold has retreated only to the levels last seen at the start of the year. In other words, an active capital outflow from gold only occurs when yields decline sharply, whereas the long-term trend favours the shiny metal. This correlation can easily be explained by inflation, which eats into the purchasing power of money in the long term.

Secondly, 10-year yields are not so much influenced by short-term Fed interest rates as economic growth forecasts. Increased chances of a recession in the foreseeable future have dampened long-term yields. In addition, there are signs that the upward movement in UST yields was too fast, setting up a corrective pullback in the near term.

In our opinion, the potential danger for gold is a further tightening of the Fed’s tone, i.e. hints of new steps of a 75-point rate hike and a willingness to keep rates above inflation. But so far, we have seen a significant outperformance of inflation over key rates, and comments from FOMC members indicate a willingness to stop with a tightening in the 3.5-4.0% area, with no attempt to ride out inflation and a reversal to a rate cut as early as 2024. Such outlooks are keeping long-term bond yields in check and, at the same time fuelling interest in a strategy of buying gold during intense downturns.

Locally, creeping upward bond yields are working for sellers of gold. This also has a bearish signal in the form of consolidation below the 200-day (or 50-week) moving average.

However, gold’s resilience drew attention when markets overestimated expectations of a rate hike from 50 to 75 points and multiple buying gains on dips under the 200-day moving average since December last year.

The FxPro Analyst Team