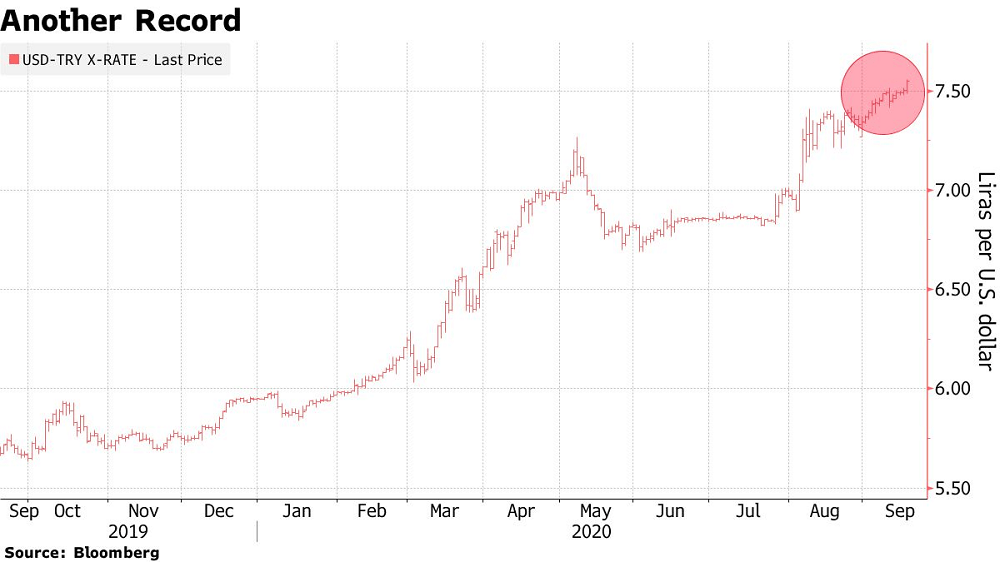

The Turkish lira fell to a record low after the U.S. Federal Reserve’s downbeat assessment of the economic outlook on Wednesday spurred demand for safer assets. The currency declined as much as 0.7% to 7.5574, extending a losing streak that’s seen it weaken in all but one of the past 14 sessions. Turkish state lenders intervened to slow the depreciation.

Government-owned lenders sold at least $500 million on Thursday, according to two people with knowledge of the matter, who asked not to be named. State banks don’t comment on interventions in the foreign-exchange market. The depreciation is piling pressure on the central bank to raise rates when it sets policy on Sept. 24. With inflation running at an annual pace of close to 12%, analysts say monetary policy remains too loose to anchor the lira.

So far though, the central bank has refrained from raising its benchmark repo rate, which stands at 8.25%. It has been driving borrowing costs higher by tightening liquidity instead, pushing the weighted-average cost of funding to 10.32%.

Lira Slumps to Record as State Banks Sell Dollars to Stem Slide