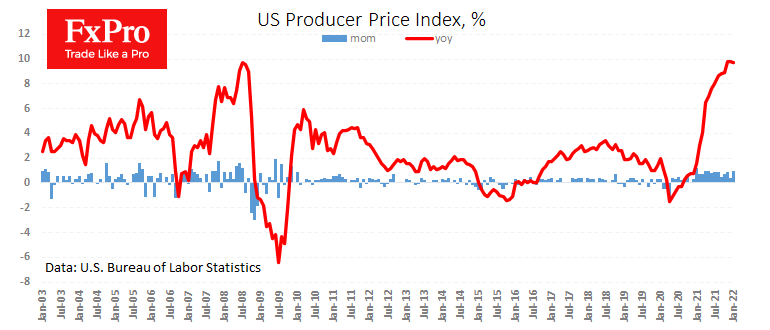

US producer prices rose 1% in January, double analysts’ forecasts. The annual growth rate slowed from 9.8% to 9.7% for the first time after nearly two years of gains, but analysts had been bracing for a sharper decline, expecting to see a slowdown to 9.1%. The core producer price index (excluding food and energy) slowed from 8.5% to 8.3%, against an expected 7.9%.

This is a new batch of bullish news for the dollar. The continued high rate of price growth continues to feed the ultimate inflationary spiral, demanding a more hawkish response from the Fed. The CME FedWatch Tool shows that markets are laying down a 62% chance of a 50-point rate hike in mid-March, a much higher rate than we can see from other G7 central banks, which makes Treasury short-term bills more profitable and feeds interest in dollar purchases.

Potentially, only the Bank of England was close to a radical move as a 50-point hike last month. But the markets are now expecting a 25-point rate hike from the Bank of England at the next meeting and do not expect any hikes from other central banks in the coming months. It is not surprising to see an interest in the USD and DXY growth in this environment.

The FxPro Analyst Team