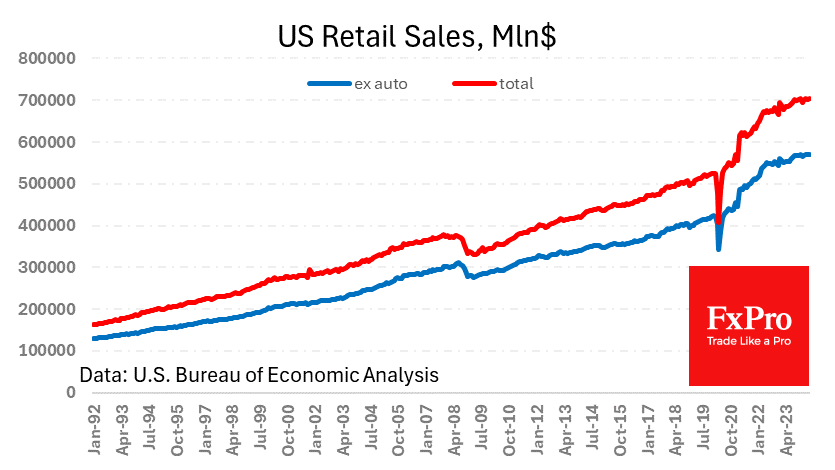

US retail sales rose 0.1% in value for May, worse than the 0.3% rise expected after a 0.2% decline a month earlier. Total sales were 2.5% higher than a year earlier, lagging the 3.3% inflation over the same period. In other words, there was a decline in consumption in real terms. At first glance, this is surprising given that wages are adding at a 4.0% y/y rate, and employment is growing steadily. However, adding to the equation the soaring cost of servicing credit card debt and a very low savings rate by historical standards, things start to look up.

We don’t see a decline in consumption as we do in times of crisis, but a clear slowdown that may precede it.

At the same time, gloomy thoughts about the US economy are tempered by an impressive 0.9% jump in industrial production for May. This is more than twice as strong as expected. The industrial production index rose to its highest level since October 2022 and is only 0.8% below its historical peak reached in September 2018.

In summary, today’s package of statistics points to a consumer shift towards a savings model but also refutes the most pessimistic expectations of a recession with a strong gain in manufacturing. This combination of data favours extending current rate levels, providing no food for either hawks or doves.

The FxPro Analyst Team