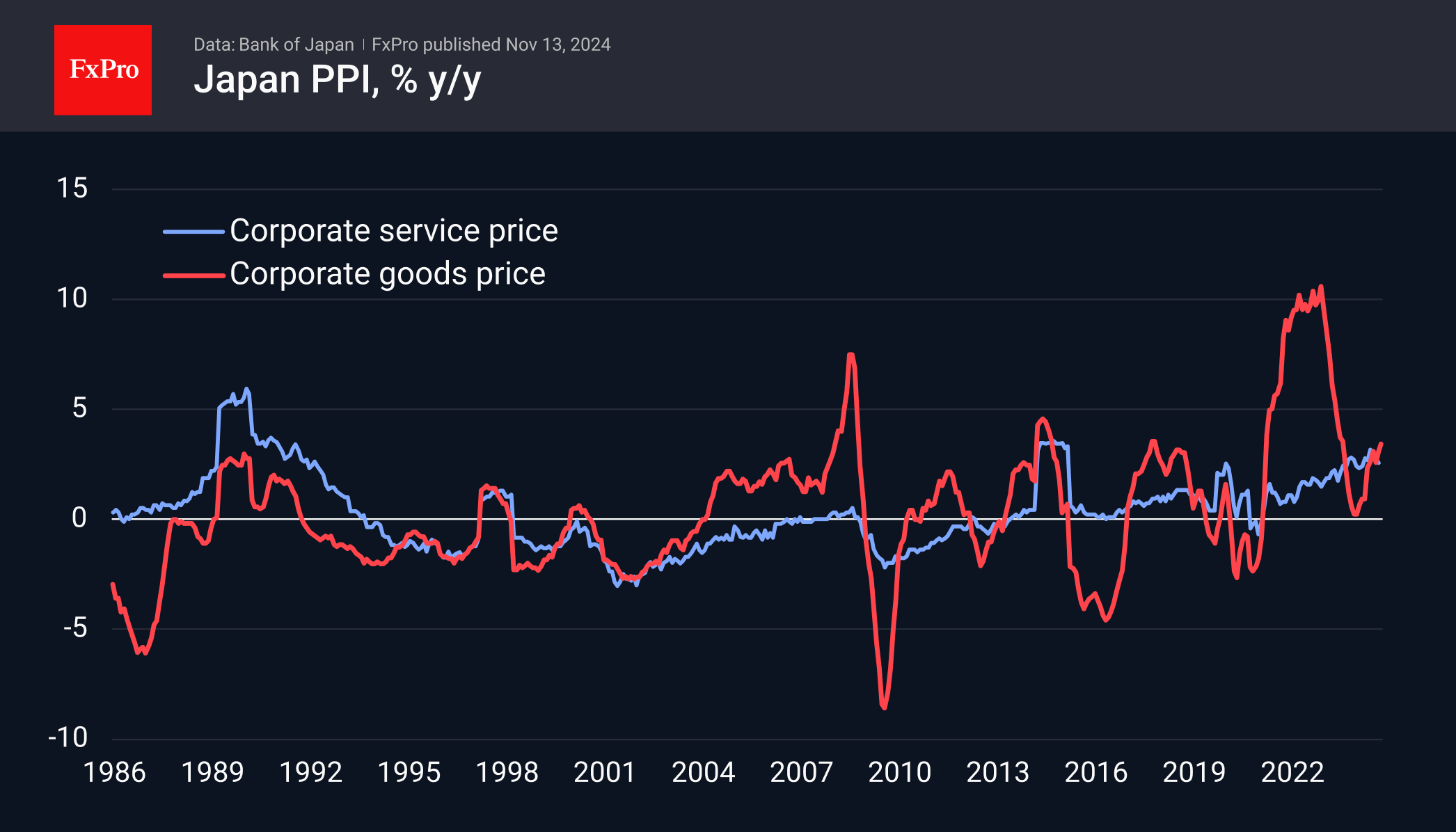

Japanese inflation continues to gain momentum ahead of expectations, as evidenced by the latest release of the Domestic Corporate Goods Price Index. This indicator accelerated from 3.1% to 3.4% y/y in October, against an expected slowdown to 2.9%.

The index hit a local low of 0.2% y/y in January and has since gained momentum as the previous yen weakness and exchange rate volatility premium have been passed through to prices. The price index tracked by the Bank of Japan has risen in 11 of the last 12 months. This brings the central bank back to the question of whether further monetary tightening is needed.

Japan Corporate Service Price Index has been rising modestly for about three years, with the latest reading for September at 2.6%. This is a less volatile measure of inflation and will not be as easy to reverse.

The headline CPI has reversed from 2.2% year-on-year to 2.5% in September. Core inflation hit a low of 1.9% in August and bumped to 2.1% in September.

USDJPY went above 155 on Wednesday, up more than 10% from its lows in mid-September when it became clear that the Bank of Japan would be in no hurry to raise interest rates. In this context, higher inflation has the potential to push the Yen lower rather than higher. Markets will move away from a currency that is losing value without the central bank’s efforts to curb price increases.

The FxPro Analyst Team