Global markets remain in narrow ranges at the end of the week, balancing hopes for a new economic stimulus package with election uncertainty. The final debate that took place last night between Trump and Biden did not provide much clarity. However, surveys continue to point to the lead of the Democratic Party nominee.

Markets are wary of survey results, having been burned by their mistakes four years ago. Trump’s opponent, Hillary Clinton, showed even bigger lead in the polls back then, but eventually lost the election. This difference was because some preliminary results were not representative and that some people avoided publicly expressing support for Trump because of his eccentric remarks.

The markets assume that the polls are still misrepresented for the same reasons. Remembering how close the results of the 2016 elections were, investors are becoming increasingly cautious, which could result in a sharp surge of volatility in the few days before the elections and the hours after the first results.

Further complicating the puzzle is the fact that observers in 2016 were also wrong about what the Trump presidency would bring them. There were concerns that threats of trade disputes with China and Mexico could lead to market failures and economic deterioration. Trump’s victorious speech in 2016, however, triggered a powerful rally in the markets as he promised to launch massive infrastructure projects and reduce taxes.

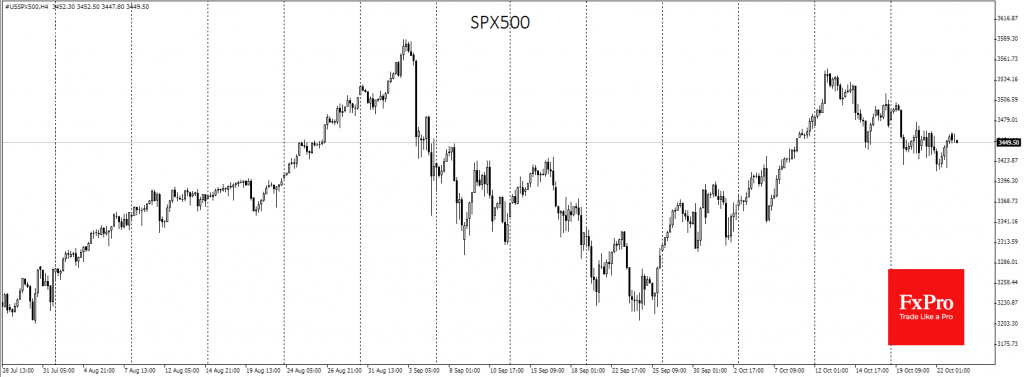

Fooled four years ago by false predictions about Donald’s chances of winning and his impact on the economy, investors now seem to be avoiding explicit bets on one outcome or another. As a result, there is moderate pressure on the US markets, where stock indices have been on a downward trend for the past two weeks and the dollar for the last four weeks. It is to be expected that these trends may intensify just before the elections.

The stronger the pre-election decline, the bigger the post-election surge can be, based on the logic of “buy the rumour, sell the facts” and “buy the recession”. What is also true is that one can be very disappointed if we ignore the idea that stocks may fall due to changes in White House policy or even expectations of such changes.

The FxPro Analyst Team