The US labour market is becoming increasingly tight, but at the same time, the rate of job alternation is increasing steadily.

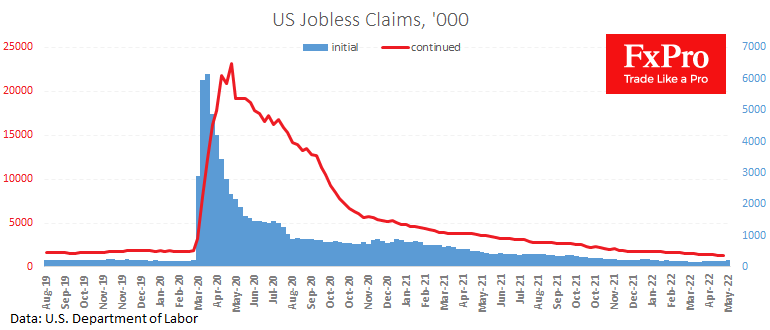

The latest weekly data shows that the number of new jobless claims is dropping further to 1.317M, a new low since 1969 when the US population was 40% less than now.

At the same time, the number of initial claims last week stood at 218K against 197K a week earlier, continuing the upward trend of the previous two months.

Since the recurrence rates are methodically declining and the latest employment report noted an increase in employment, it is logical to assume that the rise in initial claims is due to people being more active and finding work quickly.

One of the secondary effects of the current labour market situation might be a continued high rate of wage growth. This is a good signal of economic activity. Still, it should also increase the vigilance of the hawks at the US Federal Reserve, setting them up to tighten the monetary policy nuts tighter and faster.

The FxPro Analyst Team