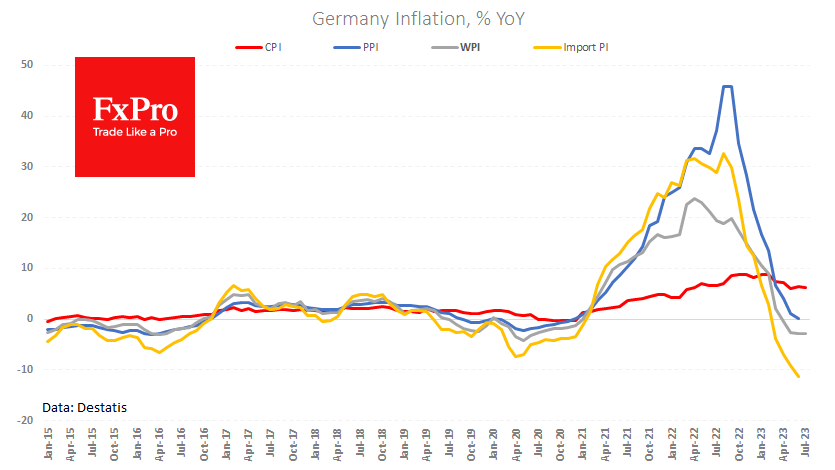

Wholesale prices in Germany dropped by 0.2% in July and decreased by 2.8% compared to last year. These figures were lower than economists’ average forecasts, with 0.1% and 2.6% declines, respectively. This indicates a weaker inflationary pressure than expected.

The main factors behind the falling prices were the lower costs of imported raw materials and energy, which enabled manufacturers and wholesalers to reduce their final prices, despite a tight labour market and higher borrowing costs.

According to recent polls of major financial media, analysts expect the ECB to raise its interest rate in September and then pause for a while. The latest inflation data reduces concerns about inflation and increases the chances of a near-term rate hike.

This is bearish news for the Euro, which has lost 0.3% of its value against the Dollar since Monday morning, reaching a low of 1.0915 – close to the levels seen in early July.

The FxPro Analyst Team