The threat of inflation is much higher now than after the global financial crisis of 2008-2009. In July, price data repeatedly exceeded expectations. Today, this evidence was confirmed by Australian CPI and German Import Prices. In previous weeks, the inflation figures were above forecasts in the USA, the UK and some big EU countries.

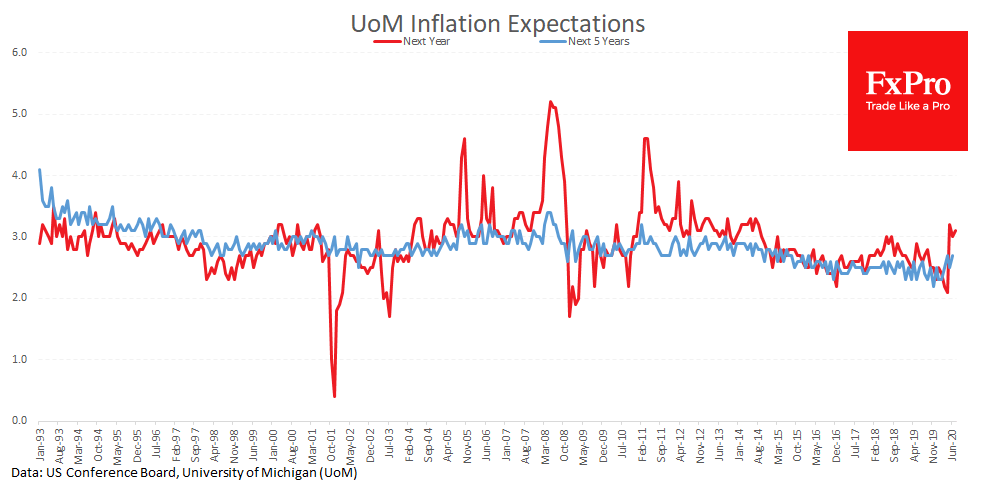

Inflationary expectations for the US also show a significant jump. July estimates of the University of Michigan noted an acceleration of Next Year inflation to 3.1%, and the 5-Year one to 2.7%, adding sharply since May. This is in stark contrast with the current declining sentiment.

The growth of inflationary expectations is often interpreted as a sign of economic acceleration. However, this time it may be a sign of stagflation (a mix of rising prices and falling economy). Yesterday, the Conference Board noted a decline in consumer confidence, confirming the assessment of the UoM.

For the Fed, such a combination of factors is a real nightmare. After all, the Central Bank, being afraid to release a genie of inflation, will be limited in pressure on interest rates.

The FxPro Analyst Team