Important economic events of the week

December 09, 2024 @ 15:29 +03:00

This coming week is likely to be the last fireworks show for the markets, as it is overloaded with major central bank decisions and several landmark economic publications.

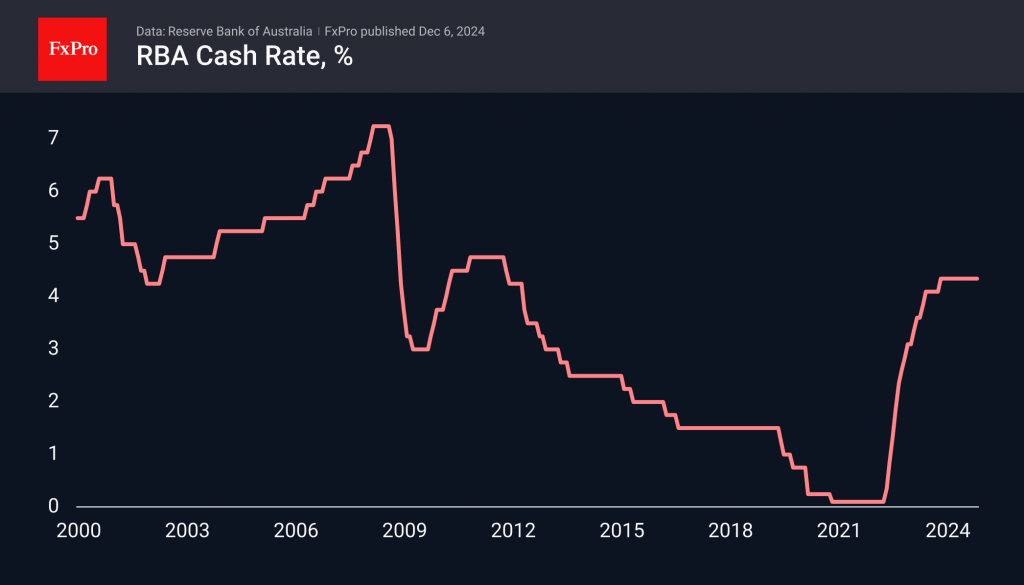

Tuesday will start with a decision on the Reserve Bank of Australia rate, which is at a 12-year high of 4.35% for over a year. The average analysts’ forecast doesn’t suggest a cut this time either. However, all G10 bloc colleagues are actively cutting rates. Will we see, if not a cut, at least a hint of one?

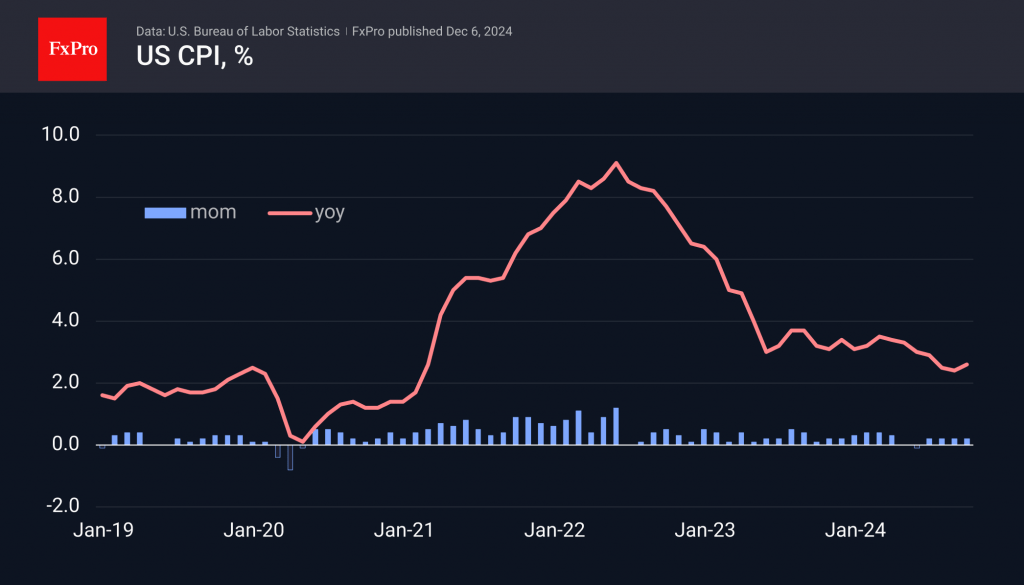

On Wednesday, US consumer inflation will be released. The reversal of annual rates to growth, Trump’s rise to power and strong macroeconomic data have fuelled doubts in the Fed about the need for further aggressive rate cuts. These statistics will be crucial for the last Fed rate decision of the year on 18 December.

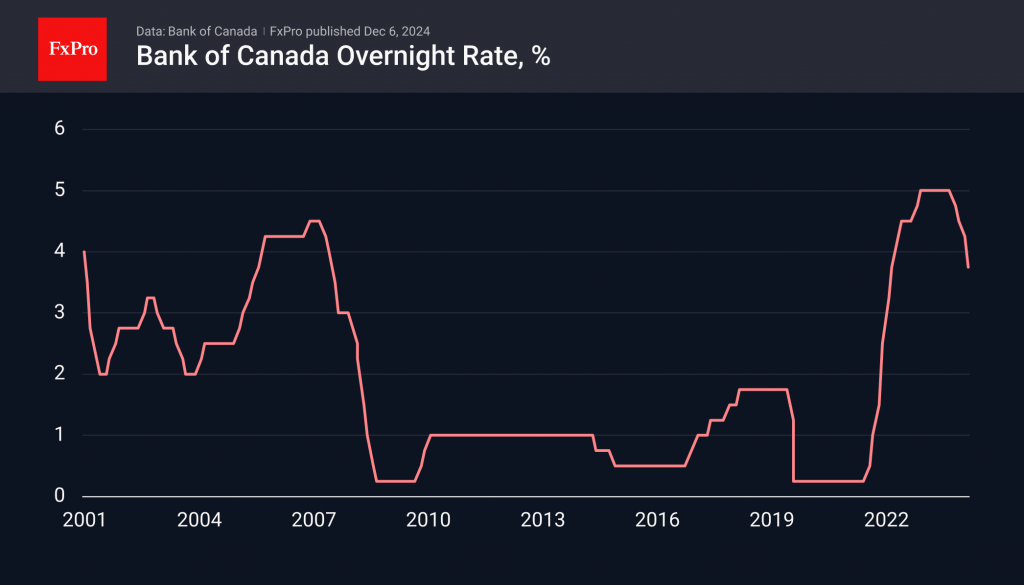

Also, on Wednesday, the Bank of Canada will decide the rate. There, the rate was cut from 5.00% to 3.75% in six months. The last move in November was by 50 points at once. The multi-year lows of the Canadian dollar may force the BoC to reduce the rate step or take a pause.

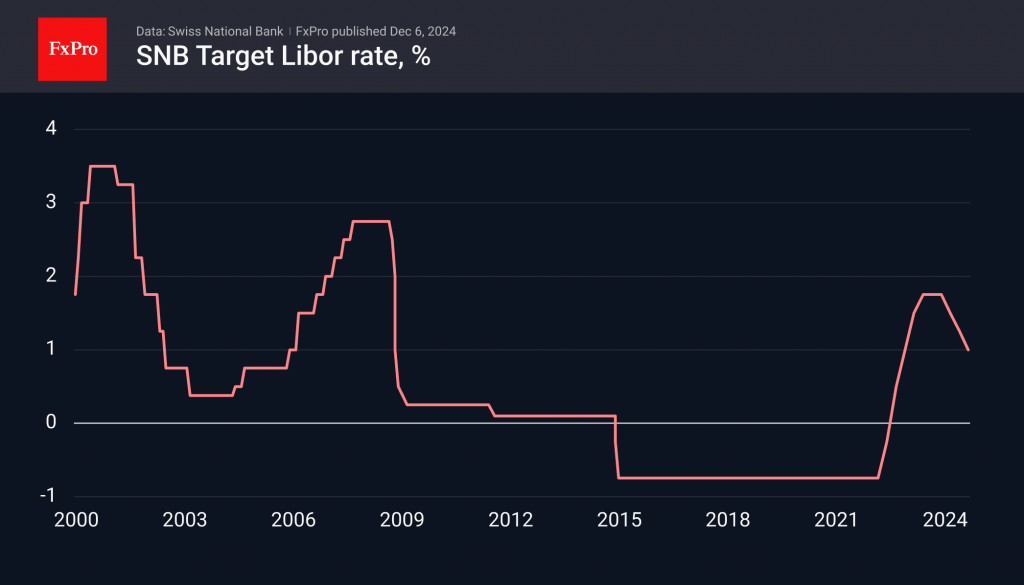

Thursday is the Swiss National Bank’s key rate decision. This happens once a quarter, and the three previous meetings this year have ended with a cut. The latest market forecasts indicate a 70% probability of a 50-point cut from the current 1.0%.

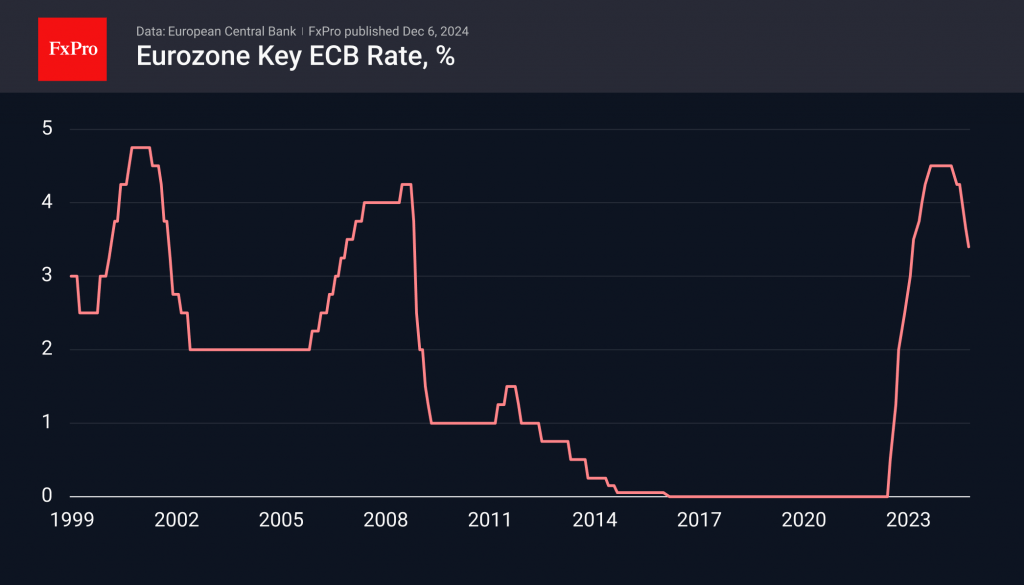

Also on Thursday is the ECB key rate decision, which is now at 3.4% vs. 4.5% at the peak of the cycle. Reductions are due to cuts and revisions of spreads between other key rates. The most likely scenario is a cut of another 25 pips to 3.15%. Equally important will be the comments at the subsequent press conference. Keep an eye on the euro, which, pricing 1.05 to USD, is walking on the edge of the cliff.