China agreed to purchase an additional $200 billion in U.S. goods over the next two years as part of the “phase one” trade deal. The additional purchases will come on top of the 2017 U.S. export numbers. The deal stipulates that Beijing will buy $77 billion in additional goods and services in 2020 and $123 billion in 2021 to meet the total $200 billion. China bought $186 billion of U.S. goods and services in 2017.

Combined with the new incremental agreement, U.S. exports to China should in theory climb to $263 billion in 2020 and $309 billion in 2021. Either amount would mark a record-breaking acceleration for U.S. exports to China.

The two nations signed the first-phase trade agreement Wednesday afternoon at the White House. The globe’s two largest economies have for the better part of two years slapped tariffs of billions of dollars’ worth of each other’s goods in one of the most protracted trade battles in modern American history.

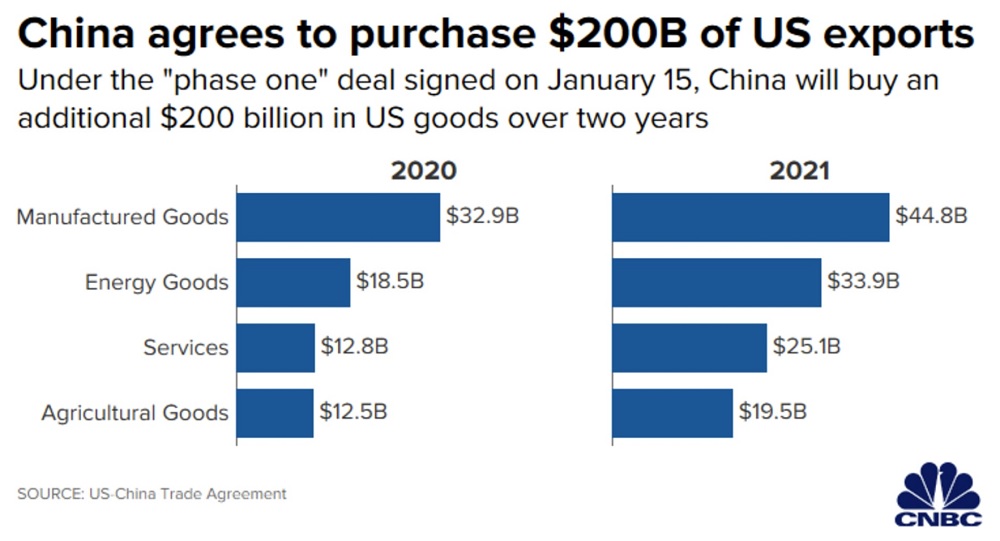

The composition of that additional $200 billion is as follows:

Manufactured goods: $32.9 billion in 2020, $44.8 billion in 2021

Agricultural goods: $12.5 billion in 2020, $19.5 billion in 2021

Energy goods: $18.5 billion in 2020, $33.9 billion in 2021

Services: $12.8 billion in 2020, $25.1 billion in 2021

Manufactured goods include industrial equipment, electric equipment, pharmaceutical products, vehicles and optical instruments. Agricultural products include oilseeds, meats, cereals, cotton and seafood.