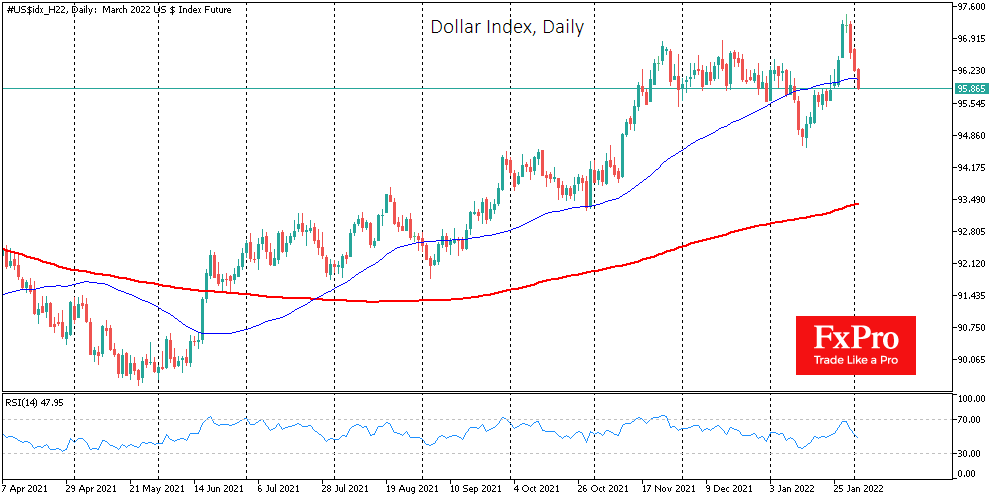

At the end of last month, the dollar index renewed 1.5-year highs after confirmation of the Fed’s plans to tighten monetary policy quickly. Since then, the US currency has given up some ground, but for now, there are visible chances that the upward trend for the dollar could stay with us in the first half of the year.

The growth of the dollar started in May and June last year, with lows in May and an impressive growth impulse in June. The first leg there was on speculation, later confirmed, that the Fed was ready to cut monetary support to the economy. Later on, we received more and more signals of tightening the regulator’s stance.

The Fed acted much more quickly than after the global financial crisis, as the economy did not fall into recession this time on mere signals that there would be less support. And yet it is still considered good to criticize the central bank for having overlooked inflation.

And the central bank is in a hurry to meet expectations by not only starting the tapering of QE in November but also doubling the pace late last month. The balance sheet purchases will end in March, with the first interest rate hike expected at the same time. Remember, after the financial crisis, almost a year passed between the announcement of the tapering idea and its commencement. A pause of a further year was required between the end of QE and a rate increase. But even then, the Fed raised rates as slow as once in a quarter.

This year, the markets are now pricing 4-5 rate rises and a 20% chance of a 50 point hike in March, which is fast. The other central banks of the developed nations will initially not keep up with the leader.

And that has been the determining factor for the dollar’s strength in recent months and the foreseeable future: It will take months for the ECB, the Bank of England or the Bank of Japan to change their course. And in these months, interest rates in the USA will rise faster than in other major developed countries and regions, forming a pull on the dollar.

The bet that a rising dollar will cool inflation is likely at the heart of this speed: an increasing US currency will suppress imported inflation and cool down commodity exchange prices. Inflation has also become a political issue, so politicians will also morally support the Fed’s current rate.

History is also on the side of the dollar bulls, pointing out that, on average, the dollar starts rising about six months before a rate hike and another six months after. As the basis for this reversal, we now take not the actual hike expected in March but the start of the QE rollback.

In the coming months, the USD Index should recover to above 100, back to where it was in March-May 2020. However, there are big doubts that the growth of the American currency can go much further.

Current rate expectations appear to be overstated and suggest that the economy can sustain this rate of tightening without slipping into recession. And previous years of very sluggish growth have demonstrated how quickly minimal rate hikes cool down the economy. In 2018, markets were stressed by plans for further rate hikes alone, and in 2019, the FOMC cut the rate although the economy was growing.

Another parallel is also interesting. The last time the US rate was raised 50 points was in May 2000. This precipitated a fall in the markets, and preparations for this increase were probably the reason for the start of the dot-com bubble implosion.

The Fed later aggressively cut rates, but this did not help the markets or the economy. We saw a similarly excessively harsh and misguided response to inflation in 2009 from the ECB. Back then, the spring rate hike was also rolled out in September, and much more support was needed for the markets and the eurozone afterwards. But that was later. In the meantime, preparations for a Fed policy tightening will push the dollar uphill.

The FxPro Analyst Team