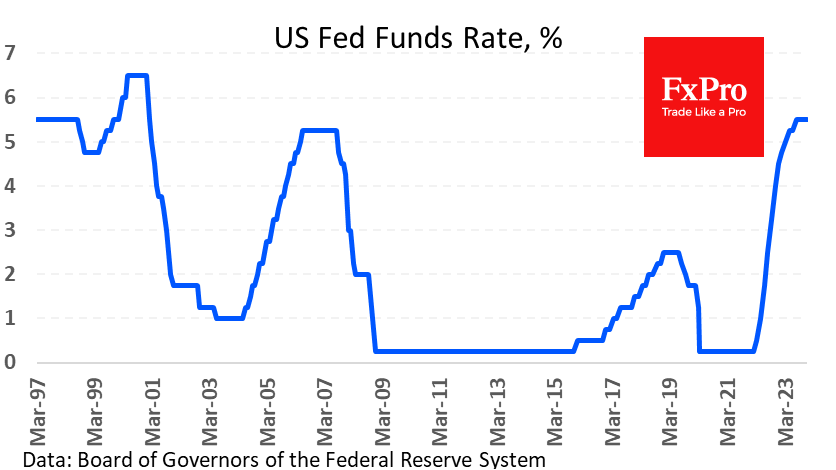

The Fed expectedly kept the key rate at the highest level in 22 years in the 5.25%-5.50% range but kicked off a powerful rally in equities and dollar sell-off with a dramatic change in rhetoric. Despite the tight monetary conditions, it gave key indices fuel for a rally. The Dow Jones hit an all-time high above 37200, while Nasdaq100 futures were only 0.5 per cent off their peak set just over two years ago as of Thursday morning.

The rally in stocks that started last Thursday added more than 5.5% to the Nasdaq100 and about 3.5% to the Dow Jones. Confirmation of the Fed’s dovish shift gave additional strength to buyers, and liquidation of short positions by bears caught off guard gave additional amplitude to the move.

The reason for the rally was the change in the FOMC forecasts, according to which the committee expects three rate cuts from current levels next year, although it had previously forecast one more rate hike this year and two cuts in 2024. That’s precisely what the markets, on average, were expecting several weeks ago. However, encouraged by the reversal in rhetoric, futures are now pricing up for five rate cuts over the next year.

Over the past two years, the market has methodically built a softer stance into expectations, and the Fed has worked to ‘manage expectations’ by cooling the bulls. But it hasn’t done so now. If, indeed, the market has switched into a phase where the tail wags dog, it is worth preparing for a cycle of high volatility in the years ahead.

Powell’s fresh momentum has taken the Dow Jones index further into overbought territory on the RSI to the 85 level. Since late 2007, we have seen the index hit a similar overbought scale only three times: precisely seven years ago, in December 2016, in October 2017, and in January 2018. In the first two cases, the spike was followed by more than a month of horizontal consolidation and a subsequent spurt upward. It was only in the third case that a subsequent 2% rise in five sessions turned into a 12% correction.

In other words, despite the extremes and apparent overbought in stocks, investors should be cautious about betting on a near-term decline in the indices: we may see both a prolonged consolidation and a renewal of the highs.

The FxPro Analyst Team