Governments help the recovery, but who will help them after?

April 23, 2020 @ 12:33 +03:00

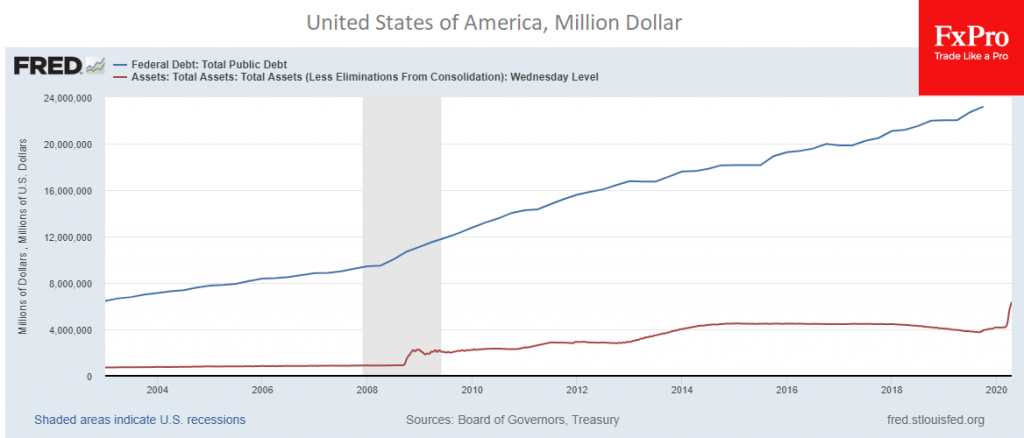

World markets are demonstrating cautious growth, caused by hopes for a third support package coupled with easing of restrictions in the economy. Oil turned to growth yesterday on geopolitics and rebounded after extreme oversell. Attention to oil clearly showed how fast politicians reacted. The Fed is sharply and decisively building up the balance sheet, starting much earlier than when the first signs of problems in the economy appeared. The U.S. government, having forgotten all the partisan conflicts, is agreeing on stimulus packages, the total volume of which is already approaching $3 trillion.

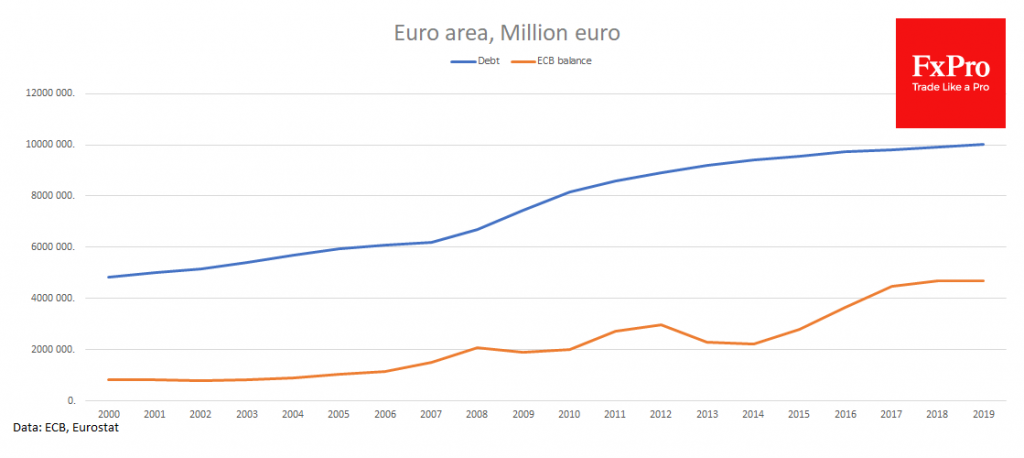

The situation in Europe and Asia is very similar: huge support packages, assistance to debt markets from the central bank. The government gives out money, continuing to accumulate debts. If even before the virus story, the financial world was wary of the growth of government and corporate debts, now they have to note an explosive increase in liabilities. We should add to this a sharp drop in budget revenues due to downtime in the economy, and the picture becomes dangerous to even the most wealthy borrowers.

How will governments reduce their burden in the future? Two options come to mind – sturdy and soft.

The severe scenario implies first restrictions on the buyback of stocks by companies and increased attention to dividends and bonuses to the management of affected companies. These measures will not be enough so that the situation may turn into a sharp increase in taxes on high income and even a cut of deposits in favour of the government. At the country level, the IMF may become the centre of negotiations on a deep restructuring of external public debt not only for weak developing economies but also for developed ones. After 2009, most of them have increased their public debt. They were helped only by zero interest rates from the central bank, which made it cheaper to service government debt. However, few managed to reduce it even with long-term minimum unemployment.

The soft scenario suggests fewer restrictions and restructuring but promises to be equally burdensome for people with savings. Inflation is a tax on capital that is gradually eroding its value. Inflation will likely accelerate much faster this time than it did 12 years ago. This time the money directly goes to those who spend it immediately: the households and small businesses. Central banks, however, are unlikely to be in a hurry to suppress signs of accelerated price growth. People who have no savings will benefit from this situation, as long as they are able to index their wages to inflation regularly.

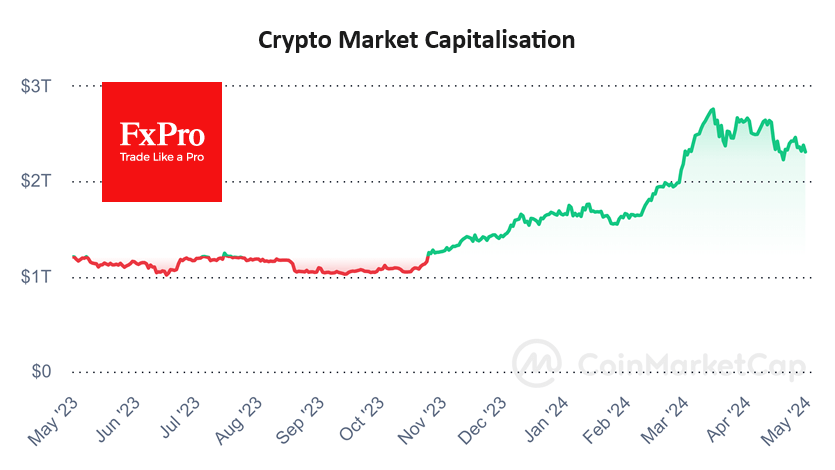

Almost certainly, we will see a combination of parameters from both scenarios, some won’t be used, and others will appear. This is what now looks logical in these conditions. However, this is a favourable scenario for stock markets in general. Often during global economic turmoil, leaders are renewed, and previous whales go into oblivion. However, this promises difficult times for the currency market, where the status of traditional safe-havens will be questioned – the debt markets of Japan, the United States, and Europe. As we saw in 2011, investors can get rid of the debt securities of reliable countries, if they are afraid of problems with their maintenance and raising new funds. And with the zero interest rates, central banks have nowhere else to retreat but to increase their balance sheets.

The FxPro Analyst Team