Gold’s sudden glow in a falling market

September 21, 2021 @ 11:12 +03:00

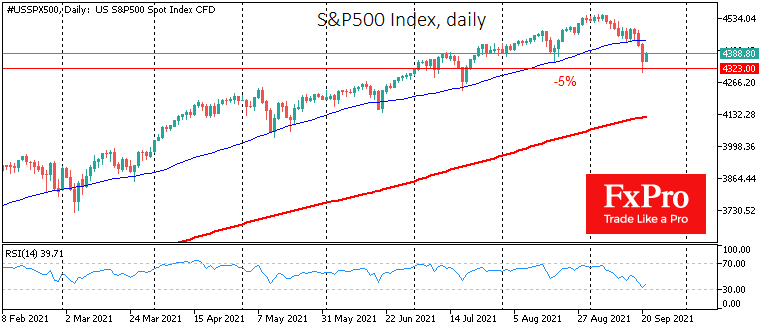

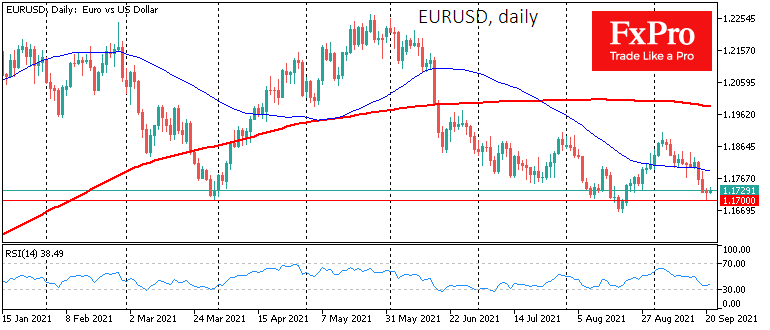

The Dow Jones index experienced its worst drop in 10 months on Monday, falling 600 points or 1.8%. The S&P500 index lost about the same amount, 1.7%. The dollar index climbed to monthly highs, trading above 93.0.

Intraday, the S&P500 had fallen more than 5% from early September peaks at one point, interrupting a 10-month streak of gains when the index did not experience such pullbacks.

Nonetheless, it can hardly be said that markets have plunged into fear. Currency, debt, and precious metals markets showed sudden resilience or even indifference during yesterday’s sell-off in equity markets.

The debt and currency markets are considered the ‘smartest’ and deepest, so their detachment from yesterday’s sell-off should be considered an important signal. It would not be surprising if, later in the day, we see increased buying in stocks of strong companies after the recent downturn.

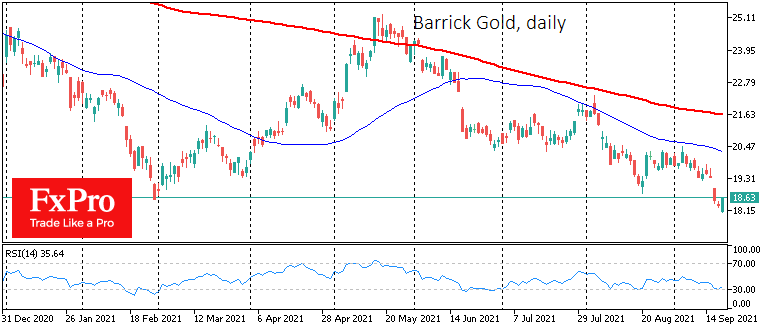

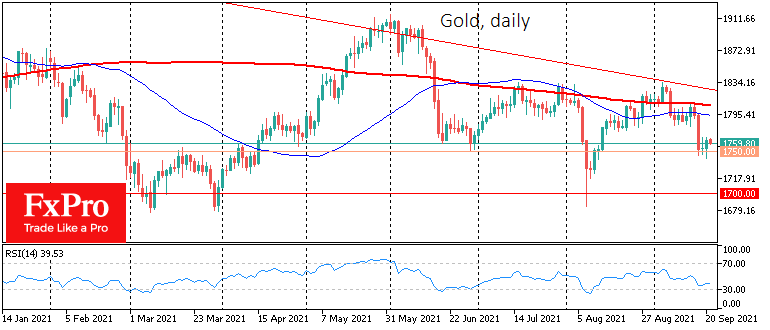

Buying in gold and gold mining stocks was even more remarkable. The long slump in the sector was interrupted yesterday with a jump of around 3% in the biggest gold stocks. Gold prices added 0.5%, gaining support shortly after falling below $1750.

As the previous months have shown, the ironclad support in gold prices is near the $1700 level. But it appears that active buyers have moved into the $1750 area.

Gold’s ability to resist the general downtrend speaks to investor confidence that global central bank policies will remain soft enough to avoid triggering a global downward asset sell-off spiral.

Of course, one should bear in mind the risks of volatility ahead of Wednesday’s Fed meeting. The outcome of the meeting and comments have, in theory, the potential to break or reinforce any trend (both long term bullish and short term bearish). In practice, however, the FOMC comes with very streamlined wording that does not cause a strong adverse reaction.

Still, the cautious gold bulls should keep in focus the area of $1800, which, if broken, would signal the breaking of the bearish correction. In case the sell-off in the stock markets intensifies further, the focus should be around $1700-1750. A break below that would signal submission of recent buyers and promises to trigger a deeper correction with near-term targets at $1500.

The FxPro Analyst Team

GBP | BOE Governor Andrew Bailey Speaks

GBP | BOE Governor Andrew Bailey Speaks