Gold is adding on Friday, and it appears that a flight to defensive assets, rather than the risk appetite that drove the price earlier this year, is behind it.

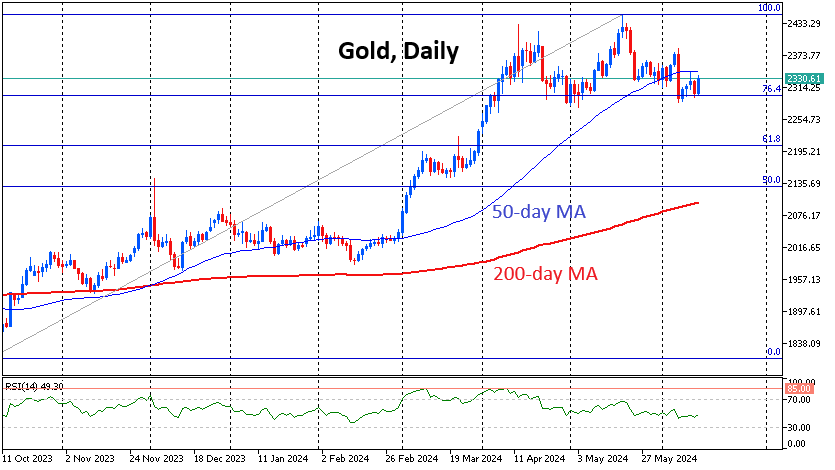

Since the start of the week, gold has twice pushed off support at $2300, where the round price level and the 76.4% retracement level from the rise from the bottom in October to the peak in May combine. The Bulls are getting additional temporary reinforcement because this same level was already successfully defended early last month.

But this support looks extremely fragile and unreliable. Firstly, last Friday, Gold went over 4% from peak to bottom, on high volumes and with a horrendous amplitude falling under the 50-day moving average. All other dynamics of this week may well be considered as consolidation of liquidity by bears for a new blow to the metal. This thesis is reinforced by the fact that this 50-day average is already actively working as resistance.

Secondly, the dollar has been rising since last Friday, as if switching into a “buy on the downturn” mode. The dollar index has pushed back from its 200-day moving average since the beginning of the month. And a rising dollar with attractive bond interest yields makes dollar bonds an effective competitor to gold.

Third, stocks are falling. Separate from the short-squeeze-backed gains in individual stocks in the Nasdaq100 and S&P500, there is noticeable heaviness in the Dow Jones and Russell 2000 indices, not to mention the 5% loss by the French CAC40 for the week. Politics was back to spooking the markets as we heard of new barrages of trade wars and the risks of increased protectionism.

Over the past decade and a half, this is not the first episode of a simultaneous thrust into gold while trouble brews. However, in 2008, 2011 and 2020, the initial rise in the value of an ounce against a background of falling stocks and a rising dollar quickly reversed into a collapse in the gold price.

It is worth keeping a close eye on how events in the currency and stock market unfold. And if the risk-off continues, buying gold will be as dangerous as picking up pennies in front of a train.

The FxPro Analyst Team