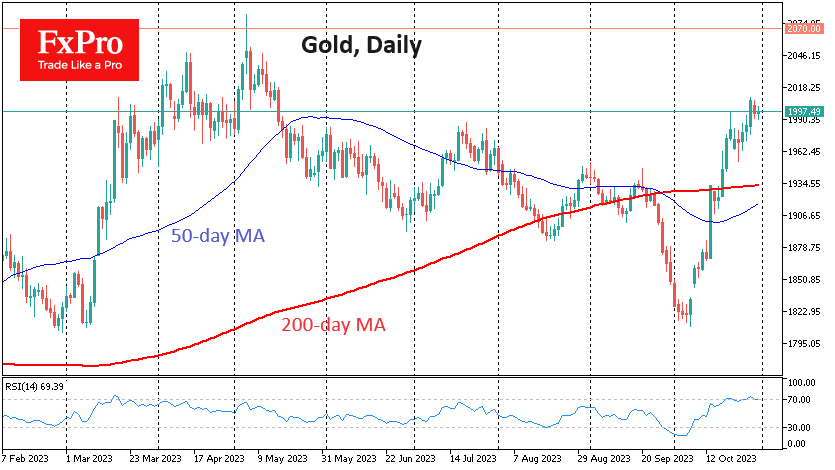

Gold broke through the $2000 mark in a decisive move at the end of last week. Corrective sentiment has intensified near this psychologically important level as some speculators rush to take profits from the roughly $200 rally from the $1810 level reached on the 6th of October.

Technically, gold remains in the overbought territory (70) on the daily RSI. And all the while, the price has been moving higher. At the beginning of last week, a brief dip below this line did not trigger a significant correction, and we saw a quick return of buyers towards the end of the week, pushing the price to new local highs.

Gold has broken through $2000 three times over the last three years, and each time, it has rallied to $2070, followed by a pullback. In 2020 and 2021, gold was pushed back below $1800; in 2022, the price came close to $1620. A retreat in September took the price to $1810 but quickly reversed to the upside.

With horizontal resistance, one deep failure and two less profound drops, gold’s dynamics resemble a distorted, inverted head and shoulders pattern. This is a bullish pattern, which in this case suggests a rise to almost $3000 an ounce, which could take up to 2 years.

But we give higher odds to the other, bearish scenario. We expect gold to follow the same pattern as in 2011-2012, when several attempts were made to consolidate above $1800. However, monetary policy reversals and a deteriorating macroeconomic outlook brought gold back to $1055 after three years of decline.

The attractive yield on government bonds justifies selling gold in the current circumstances. It shows increasing signs of peaking, which could trigger a flow of active capital out of gold and into bonds. This is doubly true as long as there is no real risk of default on US and major eurozone government bonds.

A necessary change is the fall in inflation. We are seeing more and more evidence that inflation is slowing, which is reducing interest in gold as a hedge against inflation. While this explanation is an investment myth, it has explained some retail interest. And this trend is becoming a thing of the past.

Another point is the changing expectations of market participants. As more and more major central banks switch from an active rate-hiking mode to a wait-and-see approach, the moment of policy reversal is approaching. This increases the attractiveness of long-dated bonds, gold’s main competitor.

The FxPro Analyst Team