Gold is trading at nearly $1950 an ounce, having surged since the end of July after hitting $1810 just under two weeks ago on October 6th.

Gold lost value rapidly in late September as US Treasury yields rose. However, the fall and the rise in yields stopped after the employment report. This added to speculation that the Fed will not raise rates in November, although some members are leaning towards a December hike.

The war in the Middle East sparked gold’s momentum, forming a gap at the open on Monday, October 9th. It is continuing now but has already been priced in and is unlikely to be a major driver in the coming days. There is no strong capital outflow from equity or bond markets, so there is no basis for gold buying.

At the same time, bond prices have fallen again this week. 10-year Treasury yields close to 5% – the highest since the peak in 2007. They have not been consistently higher since 2002. This has begun to undermine risk appetite in the equity market, but this change has not yet reached gold, which ignores the main reason for its decline at the end of last month.

Gold also resists the renewed pullback in the dollar, which has recovered more than half of its losses from its early October peak. The upshot is that gold is now rising against the tide. It is likely to run out of steam sooner rather than later.

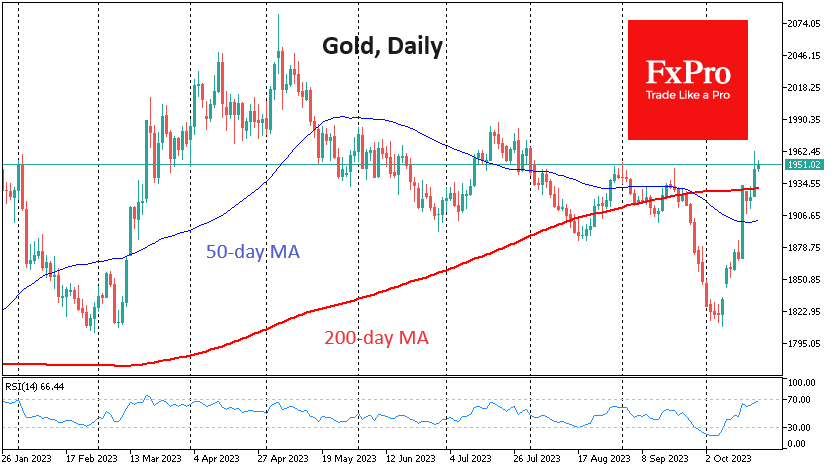

Technically, gold had necessary support on its side in the form of the 200-week average. The price touched the lows earlier in the month and quickly moved away from it. The local correction at the beginning of this week ended with a touch of the 50-week average.

In the smaller daily timeframes on Wednesday, gold consolidated above the 200-day moving average, fuelling impulsive buying and short covering, taking the price above $1960 at one point.

However, gold is now close to the overbought territory, making it vulnerable to a reversal under pressure from fundamental factors such as high bond yields and a strengthening dollar.

We also note that the war factor in the Middle East is hardly a reasonable long-term bullish bet for gold. The turbulent environment is scarcely conducive to sustained demand. The Russia-Ukraine conflict caused a similar spike in the price that we already have, but then there were fears of a supply disruption from a major producer. Even then, the price fell well below where it started before the “war rally”.

The FxPro Analyst Team