Gold rose to $2,040 per troy ounce on Tuesday morning, a two-week high. The positive momentum is being driven by risk appetite on global platforms. One of the reasons for the increase in demand for the metal could be the strength of the Chinese stock market.

The three main US indices, the S&P500, the Dow Jones Industrial Average and the Nasdaq100, closed at all-time highs on Monday, continuing a run of almost two weeks of gains after a minor correction at the start of the year. The rally was fuelled by reports that the US Treasury had reduced its bond borrowing plans for the coming months. This means that more money that would have been used to buy bonds can be used to buy stocks and commodities.

We are also paying attention to signals from a WSJ journalist who covers Fed policy. He is widely acknowledged to be effective at conveying and interpreting signals that the FOMC can no longer give in the ‘week of silence’ before the meeting. In a recent article, he noted that the ‘sharp drop’ in inflation poses a new risk for the Fed. It’s a sharp reversal from the inflation threat of the past two years. It is a return to the narrative that prevailed after the 2008 crisis when the world’s major central banks worked to raise inflation rather than contain it.

This return of an old theme is reminiscent of gold’s rally from $720 to $1,900 an ounce in 2008-2011 when there was a shift to a zero interest rate policy and the start of QEs.

At the same time, the Chinese market continues to lose investor confidence as a result of the Evergrande bankruptcy and the unimpressive measures taken by regulators to support the markets and the economy. Hong Kong and mainland Chinese stock indices have halted the recovery that began last week and are losing ground for the second trading session, trading near multi-year lows. In this environment, and particularly in China, gold is once again enjoying the status of a defensive asset.

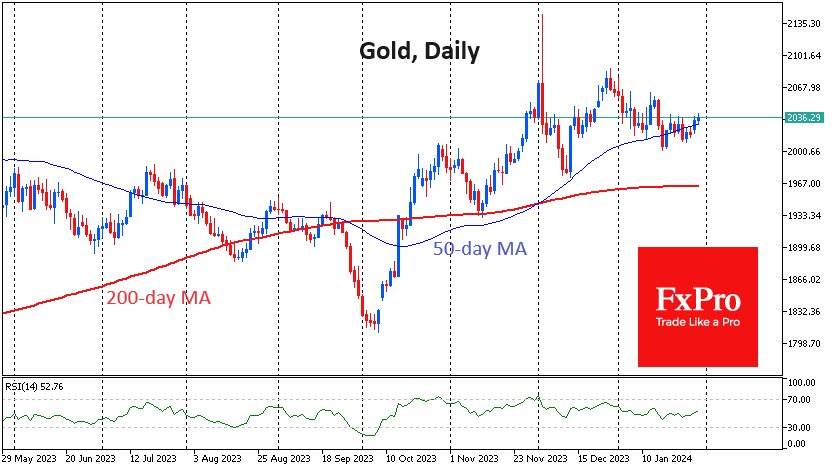

On the other hand, gold has been in a downtrend since the beginning of the year, although it usually starts the year strong. In years where we see early weakness in the first few weeks, the pressure soon builds. And we expect this trend to manifest itself as early as this week.

The price of the troy ounce could correct as low as $1,960, approaching the 200-day moving average, where the battle for the trend will likely intensify. If the bullish scenario comes to fruition, a move above $2,050 by the end of this week will significantly increase the chances of gold testing its all-time highs in the coming weeks.

The FxPro Analyst Team