Gold appears exhausted after a rally

February 22, 2022 @ 15:55 +03:00

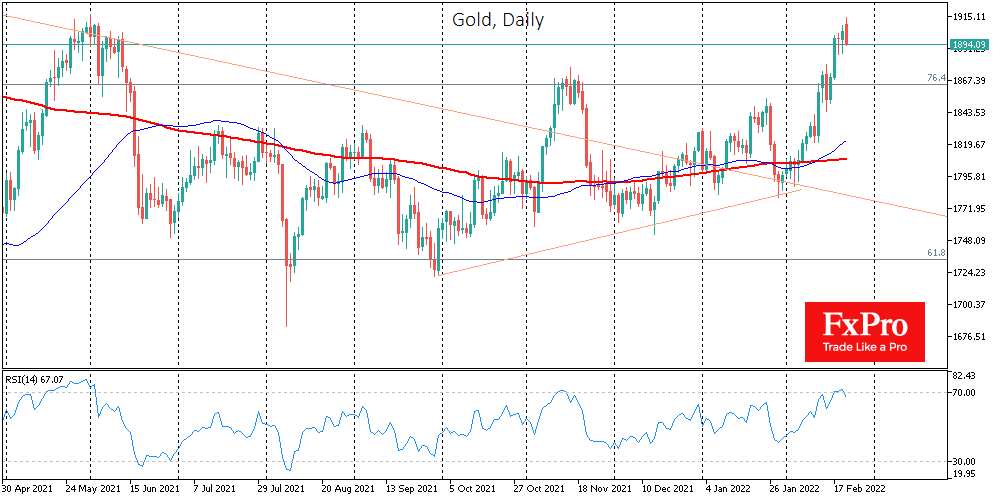

At the start of Tuesday’s trading, gold was close to $1914, its highest level since June last year. However, we already saw a pullback under $1895 and a 0.45% drop.

Interestingly, today’s opening gold rally seems more like a knee-jerk reflex to the news headlines rather than a panicked flight to the safe haven. The momentum of last week’s rise has been draining in recent days. The increasingly heated situation in eastern Ukraine, the collapse of Russian stock indices, and the more than 4% dip in European stock indices did little to move gold yesterday.

Producers such as Barrick Gold are getting a competitive advantage from the current situation, and they rose impressively last week. Still, today their prices are moderately lower as the stock is slightly overheated after a 20% rise since February 11th.

Despite the agitating geopolitical situation in Eastern Europe, there is a relatively muted demand for other safe assets. The yen and the franc have been rising steadily against the euro over the last couple of weeks, and on Tuesday morning, we saw some of the recent gains recede.

From the dynamics by the end of this week, we might be able to tell if this means a temporary pause in the rally or a reversal downwards again, as we saw in the middle of last year. Right now, the chances of both a breakout scenario and a corrective pullback from the rally since late January are roughly equal.

In a retracement scenario, gold might pull back to $1880, but it will probably stay there until it reaches $1865. If we see only a pause in trading before a new buying wave and gold gets back to rewrite the highs before the end of the week, we might see an avalanche of stop-orders triggered, accelerating the strengthening.

It took five weeks to go from $1780 to $2075 in 2020. Since the end of January, the momentum that started from the same levels has been proceeding at a similar pace.

The FxPro Analyst Team