Germany’s industrial production index jumped 2.9% in August, almost recovering from a similar drop in the previous month. This data, above the expected 0.8% rise, nominally supports the euro-dollar exchange rate on Tuesday, as does the positive surprise in the Sentix index on Monday.

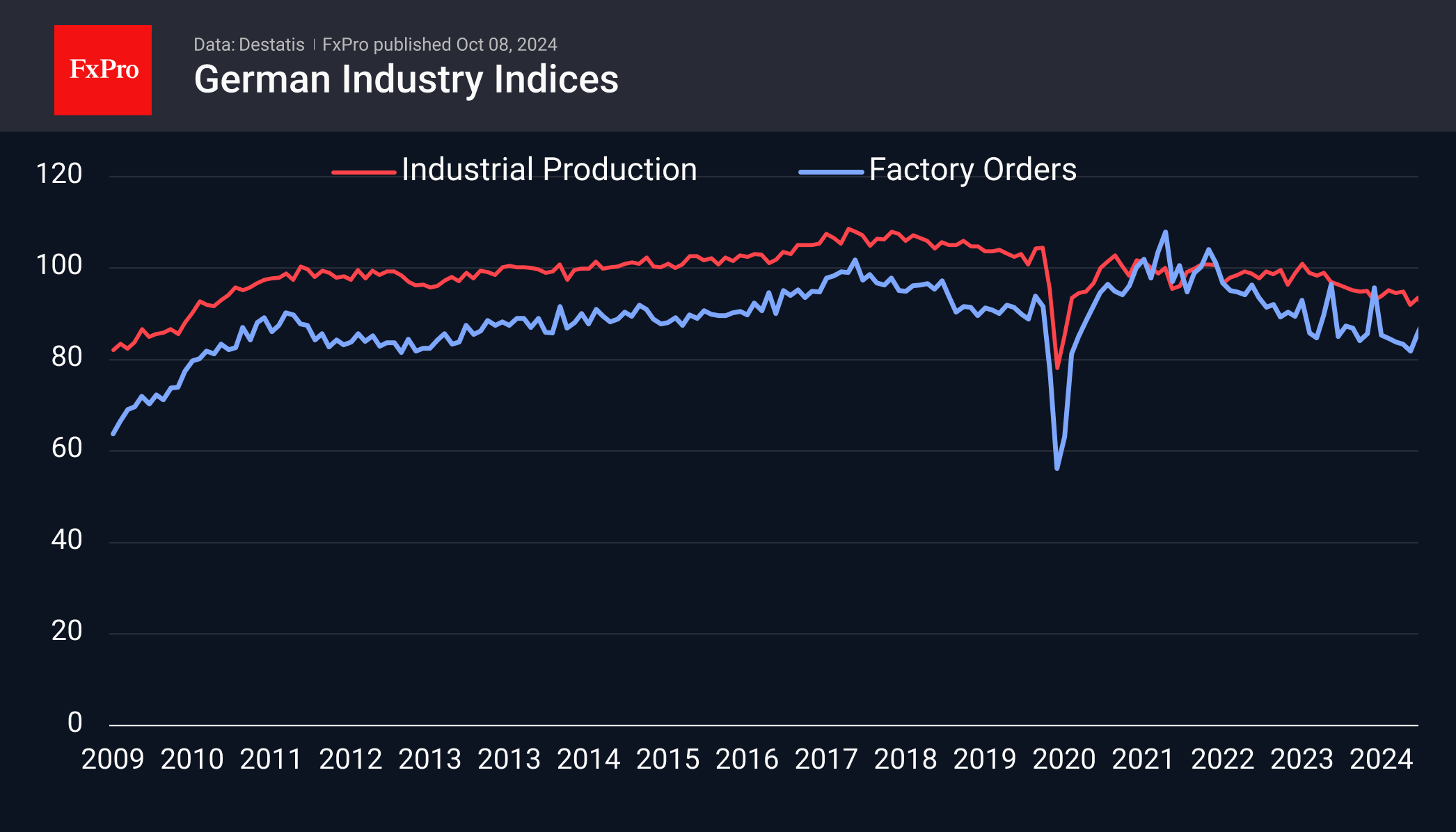

In both cases, the better-than-expected and stronger-than-expected data does not change the overall rather worrying picture. German industrial production is down 2.7% year-on-year and has been in a declining phase since February 2023, and we saw the global peak at the very end of 2017.

Sentix—the eurozone investor sentiment index—has been negative for 31 of the last 32 months despite its uptrend, compared with 25 months below zero after the global financial crisis.

Industrial orders, like manufacturing, have been very volatile in recent months, falling 5.8% in August. But here, too, there is a long downtrend, with a peak just after production.

Germany’s economic slowdown began with the first salvos of the trade war with China and continued with the cut-off of cheap gas from Russia and the abandonment of that market. In recent months, the issue of tariffs on Chinese goods and China’s potential response has returned to the fore.

It is hardly a coincidence that the peak in the EURUSD almost coincided with peaks in all the above indicators. Weakness in manufacturing and low investor confidence are translating into looser monetary policy from central banks. In particular, the ECB has not raised interest rates as much as the Fed and has started to cut rates earlier. At the same time, the strong US labour market report contrasts with the global sluggishness in Europe (albeit locally better than expected).

The macroeconomic backdrop thus supports a strategy of selling EURUSD on the expectation that the ECB will accelerate its monetary easing. Meanwhile, the Fed will reduce the pace of its rate cuts.

The FxPro Analyst Team