Germany’s Business Climate Worsens Despite Cheaper Energy

December 19, 2023 @ 12:54 +03:00

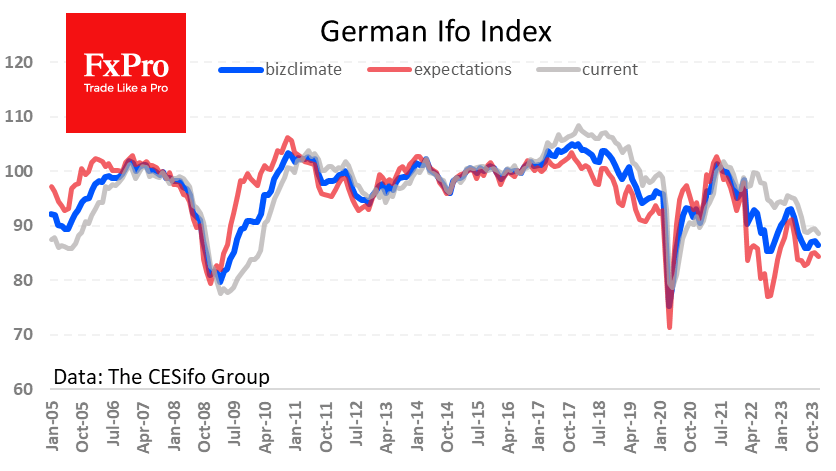

Germany’s business climate, according to the Ifo Institute, deteriorated in December instead of the expected improvement, providing further evidence that the manufacturing sector is struggling. The business climate indicator fell from 87.2 to 86.4 instead of the expected increase to 87.6. This slight decline looks like a symbol of the breaking of the improving trend since the beginning of autumn.

About a year ago, we saw a recovery in the Business Climate Index, but there were dramatic differences in the structure of this growth. The current situation assessment is now updating lows from 2010 if we exclude the coronavirus swing.

Expectations, while improved from the lows of 2022, have failed to find a basis for improvement as they did after the global financial crisis. The economy was then supported by government stimulus and low interest rate policies. Significantly, Germany was also helped by China’s abnormal injection into its economy at the beginning of the last decade, which created orders in the heavy industries of Europe’s locomotive. Chinese support is now so cautious that it is unable to reverse the trend even in its economy.

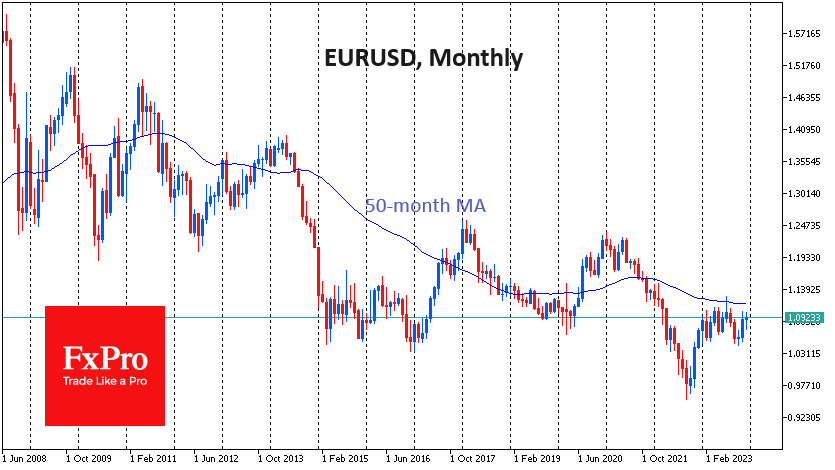

EURUSD correlates quite closely with the dynamics of the Ifo index expectations. Both set local highs in April. A drop in the expectations index could be a harbinger of pressure on the single currency in the coming months, as we did not see it booming like in 2009, 2020, or late 2022. From a fundamental point of view, the weakness in expectations for the German economy indicates that business activity is fading, causing investor pessimism and putting pressure on the ECB to switch to a looser monetary policy sooner.

The FxPro Analyst Team