German seesaw: weak demand weighs on the euro, lifts DAX

March 28, 2024 @ 17:20 +03:00

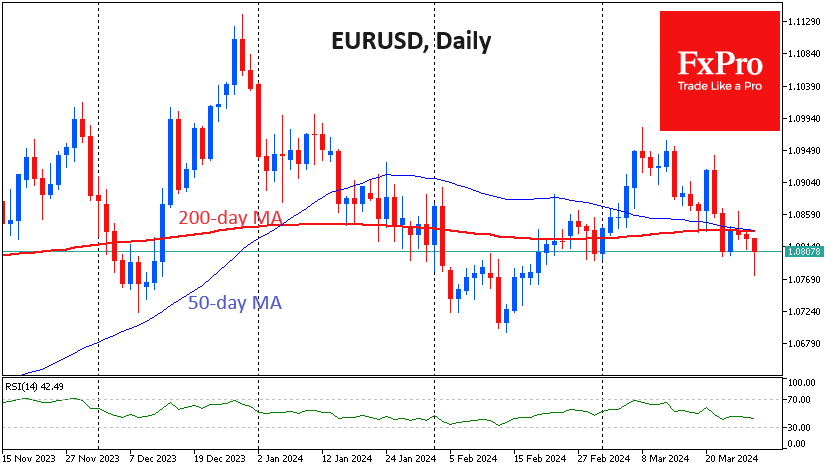

The EURUSD accelerated its decline on Thursday, losing for the third consecutive session and falling to a five-week low below 1.0790. The pair’s downtrend has been in place since the 8th of March when the latest employment report was released. The pair then failed to reach the 1.10 level.

The extended decline in EURUSD has turned the initially neutral technical picture into a negative one, with the formation of a “death cross”. The 50-day moving average is about to fall below the 200-day average.

The still-strong economy remains on the dollar’s side, pushing back the forecast for the first rate cut from March to June, bringing it almost in line with the ECB. It is also important to note that the ECB is expecting four cuts, compared to 2 or 3 for the Fed. The dollar is benefiting from this in the currency market.

At the same time, Europe is reporting weak domestic demand. German retail sales fell by 1.9% in February, the fourth consecutive month of decline. The year-on-year decline is 2.7%. The latest figure is a five-month low, but what is more worrying is the worsening trend.

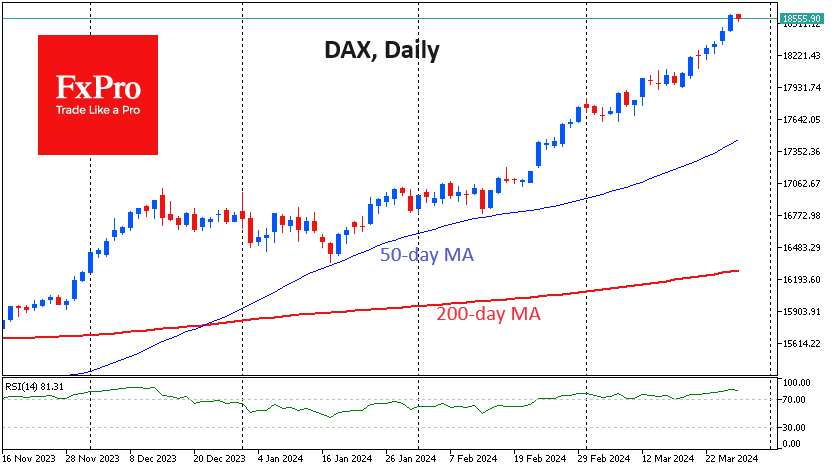

That hasn’t stopped the DAX from gaining 10% since the start of the year, twice as much as the Dow Jones, and it has gained every week since the beginning of February, hitting all-time highs in the process. The weakness of the euro has been an important factor in the German market’s outperformance, although not the main one.

The ECB’s willingness to ease policy more actively than the Fed is potentially working against the euro and in favour of German equity exporters. Right now, for Germany, it works like a seesaw.

The FxPro Analyst Team