Fragile growth in shares and perceived dollar retreat

October 29, 2021 @ 16:48 +03:00

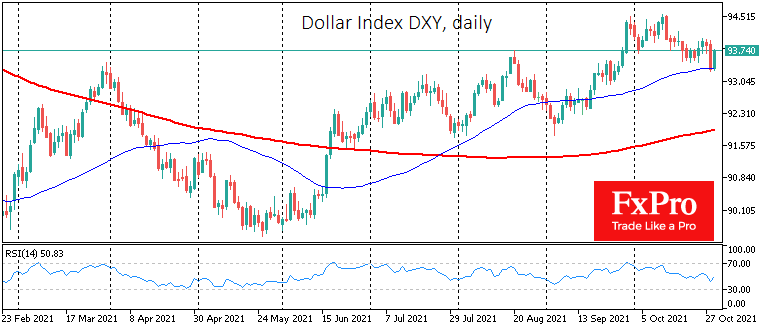

The US dollar came under pressure on Thursday, rewriting monthly lows on the DXY index. The pressure on the US currency was triggered by weak GDP data, which showed the economy growing worse than expected while inflation continued to rise faster.

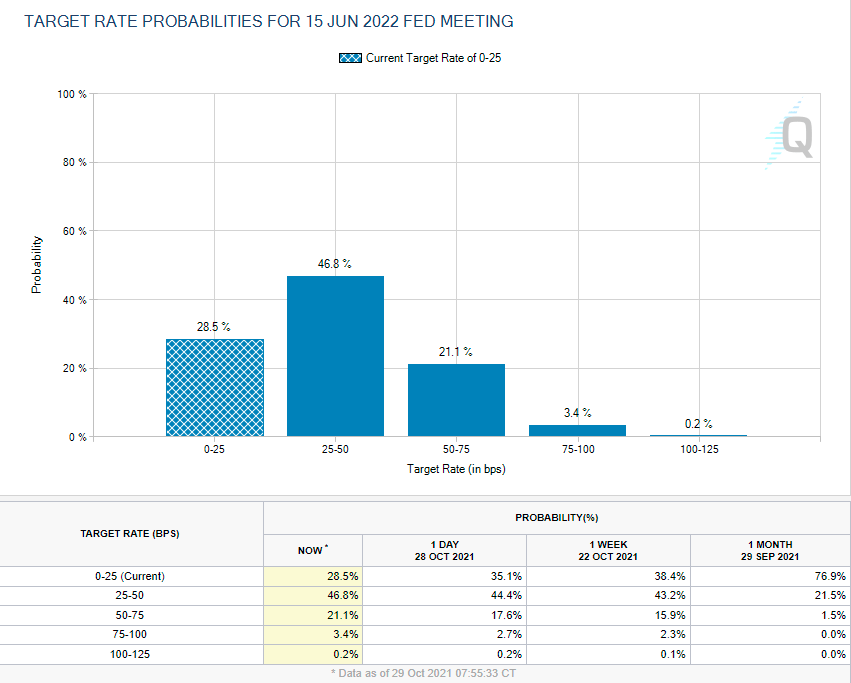

This combination brought back the markets’ fears of stagflation – the combination of a weak or contracting economy and an elevated price growth. Markets continue to strengthen in anticipation of higher interest rates. The FedWatch tool shows that futures are laying a 72% chance of a rate hike by June 2022, up from 23% just a month earlier.

The odds of the rate remaining at current levels until the end of 2022 are a paltry 4%, and the markets now consider the most likely scenario to be two hikes before the end of next year.

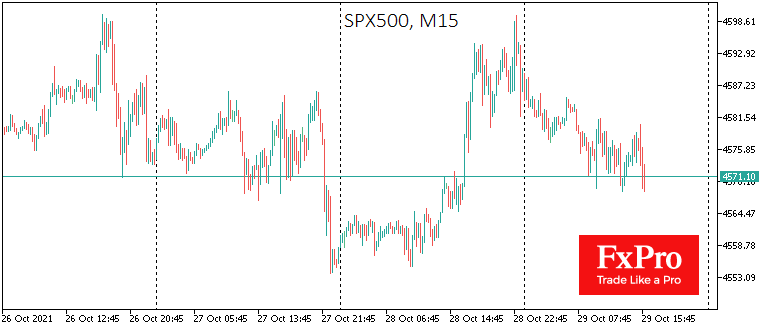

Interestingly, this shift in interest rate expectations does not appear to fuel a rise in the Dollar, nor does it stop the strengthening in the equity market. However, investors and traders should remember that markets are irrational in the short term but exceptionally rational in the long term. In this case, a sustained rise in short-term rates acts as a severe headwind to equities and commodities, although their prices may rise for a while.

It is worth noting that the Dollar has not yet crossed the line, continuing to receive support on a slide towards the 50-day moving average. This support could turn out to be the starting point for a new impulse for the Dollar to rise, as it was in September.

Additionally, it is worth paying attention to how the American markets are closing the regular session where selling dominated for the previous three days. This signals that market professionals are locking in gains in equities, despite mostly upbeat corporate earnings reports.

On the other hand, traders may not give too much importance to these worrying signs until the comments of the Fed or even until the publication of the US jobs report next week. The situation could change dramatically in the light of new data. One thing is sure – the coming week is set to be nerve-racking and volatile.

The FxPro Analyst Team