The markets on Thursday appear much calmer than on Wednesday, whilst the news background has not changed at all: COVID-19 statistics continue to break records, with more than 500K new cases reported over the past 24 hours. Germany and France have announced their ‘lockdown light’ in an attempt to battle the acceleration of coronavirus spreading. Across the pond, US legislators are still far from adopting the aid package.

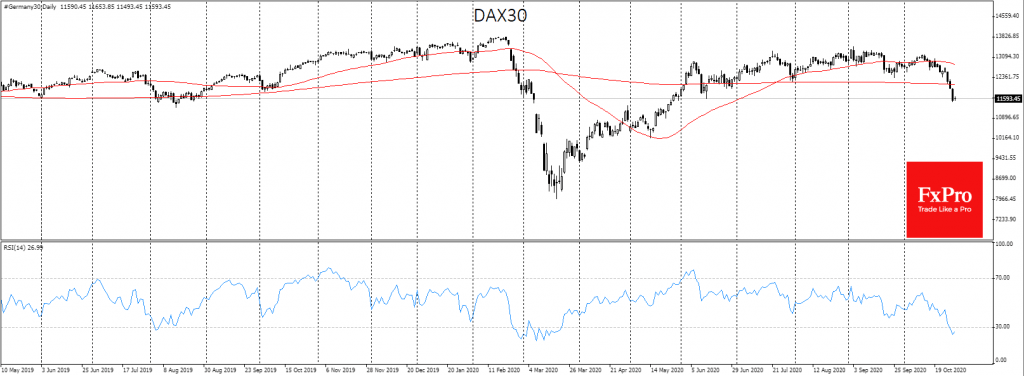

However, on Thursday morning, futures on the European and American indexes bounced back from their lows. The German DAX is adding more than 0.7% this morning after a collapse of 4.2% the day previous and futures on the S&P 500 rose by more than 1.1% after a 3.5% fall on Wednesday.

The increasing covid cases and the delay in adopting new support packages are depriving markets of fundamental confidence that the situation is about to start improving. All of this makes the current trend somewhat shaky. Earlier this year, we saw many times how quickly markets can give up early gains and return to a massive decline. The same situation cannot be ruled out this time.

Among additional negative signals, we should mention the stock and currency sell-off in emerging markets. The Russian ruble lost 2.5% to the dollar, reaching 79.23 and closing the day at historic lows to the euro above 93.0. Investors no longer seem to be able to ignore the collapse of the Turkish lira, as its steady sell-off has a significantly negative impact on the currencies of emerging economies.

Separately, the debt markets, as well as the dynamics of the Japanese yen and the franc, mean that the situation as a whole is far from panicky. The USDJPY exchange rate remains above 104.30. Although we see a rebound in the pair, the rate has not yet crossed the line on the sand at 104.0, remaining at the bottom of the trading range for the last three months.

The situation is similar with the Swiss franc, which is now retreating from its local highs against the dollar, indicating moderation in risk aversion.

Market volatility has also been reduced by the calming tone of comments from the Bank of Japan earlier this morning, which has not changed its policy but promised to continue the QE programme.

Later today, there will be an ECB monetary policy decision where markets hope to hear hints of easing in December. The recent turbulence in European markets may force the Bank to announce some new support measures as early as today.

The FxPro Analyst Team