Forget trade deal; Fed’s repo problems are serious

January 15, 2020 @ 12:56 +03:00

The official signing of the “Phase 1” trade deal between the US and China is set for today. Markets have been experiencing a rally since early December, as investors priced this news into quotes.

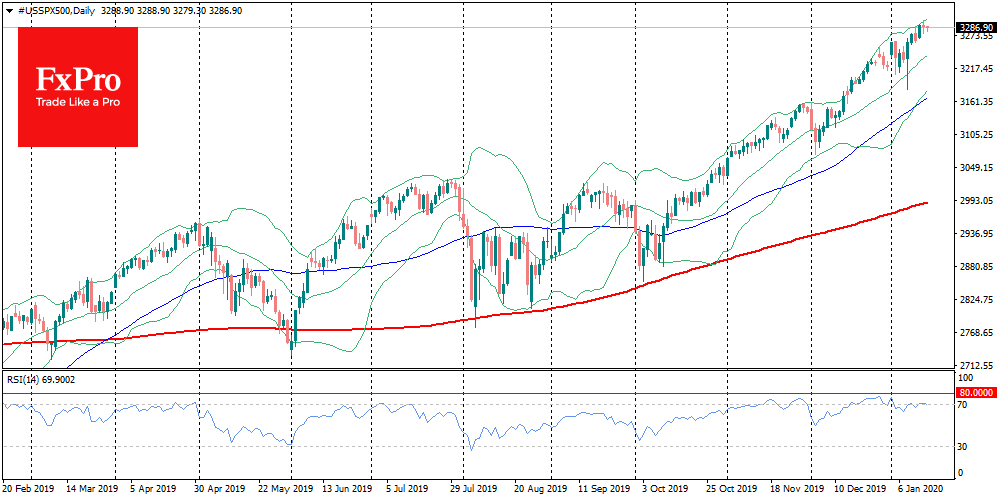

To date, the key US indexes look overbought on a variety of technical indicators, from RSI and Bollinger Bands to historically low levels of short positions. The Chinese Yuan was at its highest level against the dollar in six months yesterday, while the blue-chip index of the Shanghai Exchange China A50 has been trading at its highest levels since February 2018.

Such uniformity of opinion makes markets vulnerable to a correction in the style of “buy rumours, sell facts”. Asian markets already fully show signs of such profit-taking, as key indices on Wednesday showed some decline from the reached highs.

After signing of the Phase One a long pause on this issue is expected, so markets may well switch to other topics, including the presidential race and interbank liquidity issues in USA.

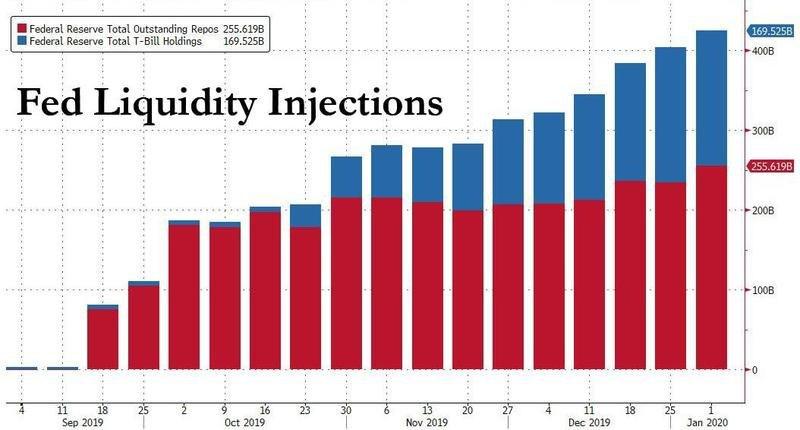

Despite relatively positive macroeconomic reports, the Fed continues to increase its support for the repo market, bringing the total injections above $400bn. Initially, it was considered a short-term problem, but since September, the volume of this emergency medicine grew almost every week.

The latest news on this issue was that the US central bank is considering giving out money directly to hedge funds. All this indicates potential problems with trust in the financial system despite soft monetary policy.

Financial problems tend to turn into economic ones rather fast, as GFC taught us. So the attention to the repo market and the Fed’s actions can now shift to the market focus for the coming months. For stock indices, the attention to this issue can quickly turn from profit-taking after the rally into a deep correction. The other safe-haven currency – the Swiss franc – turned to growth in early December.

The FxPro Analyst Team