FinCEN’s Proposed Crypto Wallet Rule Might Hit DeFi

December 24, 2020 @ 09:42 +03:00

A proposal by the U.S. Financial Crimes Enforcement Network (FinCEN) that would require crypto exchanges to collect personal information, including names and home addresses, from individuals seeking to transfer cryptocurrencies into their own wallets is poorly defined and could have widespread repercussions, say a number of regulatory experts.

The proposed rule, unveiled last Friday, would require crypto exchanges to collect this personal information from customers who transfer an aggregate of $3,000 per day to “unhosted” wallets (which are also referred to by FinCEN as self-hosted or self-custodied wallets; crypto users may know them as private wallets or, simply, wallets). Transfers of over $10,000 per day would require the exchange to file a Currency Transaction Report (CTR) to FinCEN, reporting these transactions and the individuals making them to the federal government.

The proposed rulemaking, which was published in the Federal Register on Dec. 23, has quickly drawn widespread industry backlash, with complaints ranging from the document’s poorly defined terms to the rushed process itself. Comments are due by Jan. 4, cutting what would normally be a months-long public comment period to just two weeks.

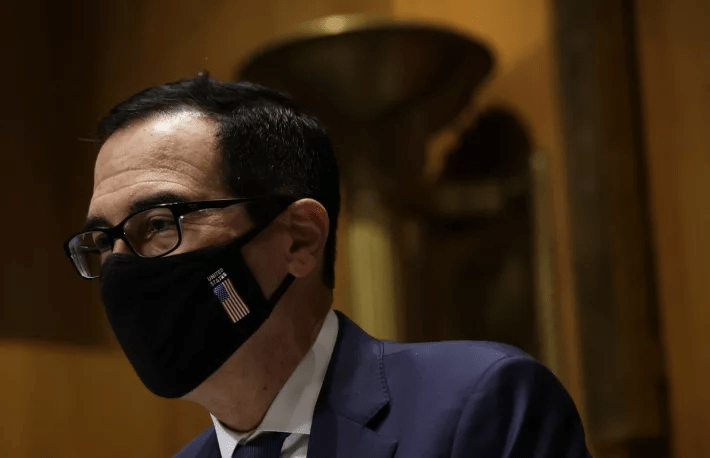

The controversial rule is said to be a personal project of Treasury Secretary Steven Mnuchin, said Jeremy Allaire, CEO of USDC stablecoin co-issuer Circle. It originally was thought to be far more stringent than the final version published last week.

Further, it appears the rule is being jammed through the rulemaking process to ensure it is implemented before President-elect Joe Biden takes office next month, said Nick Neuman, CEO of bitcoin self-storage firm Casa.

The shortened comment period reduces how much time exchanges have to determine whether they need to change their internal processes to remain in compliance, said Amy Davine Kim, chief policy officer of the Chamber of Digital Commerce advocacy group. How exchanges would comply also remains an open question, she said.

‘Breaking’ DeFi

The rule itself is unlikely to impact end users, said Neuman. While there were initially rumors that Treasury’s proposed rulemaking would be far more stringent – potentially going so far as to ban unhosted wallets outright – this would have been far more difficult to implement.

“What isn’t clear is how the regulated service providers like exchanges will be actually implementing this,” he said. “There’s going to be compliance necessary if the rule passes among exchanges, brokers, other custodians, they’re going to have to implement this in one way or another and how they implement this will be important to what the user experience is like.”

Exchanges might need to whitelist individual wallet addresses to ensure funds aren’t sent to a wallet without the required personal information, he said.

One area that does seem likely to be impacted is decentralized finance (DeFi). Multiple people told CoinDesk the proposed rule’s biggest – and most unclear – impact would be on DeFi projects.

For one thing, many DeFi projects rely on smart contracts to store or escrow funds. Users engage with, say, Compound by connecting their MetaMask wallet to the lending platform. Subsequent transactions are reflected in the wallet itself, and unique to the user’s holdings.

Plus, these smart contract-powered platforms don’t have physical addresses, nor are they necessarily operating under the auspices of an actual company. In short, Uniswap would persist if Uniswap’s founders were arrested. It is unclear how such DeFi platforms would be treated under FinCEN’s proposed rule.

FinCEN’s Proposed Crypto Wallet Rule Might Hit DeFi, CoinDesk, Dec 24