Even though the Bank of Japan left the key rate and parameters of the QE programme unchanged, the central bank’s inaction increased the pressure on the national currency. This resulted in USDJPY reaching 156.80 and EURJPY reaching 2007–2008 levels, which started a sharp decline due to the global financial crisis and related deleveraging.

USDJPY has already surpassed the levels where the October 2022 intervention took place and where the market reversal occurred about a year later. This begs the question of ‘when’, although the question of ‘will they’ is still relevant.

Central banks and governments do not focus on the nominal levels of individual currency pairs. They care about dynamics, as abrupt changes can cause inflation and economic shock. Therefore, it is more useful to look at the dynamics to a basket of currencies.

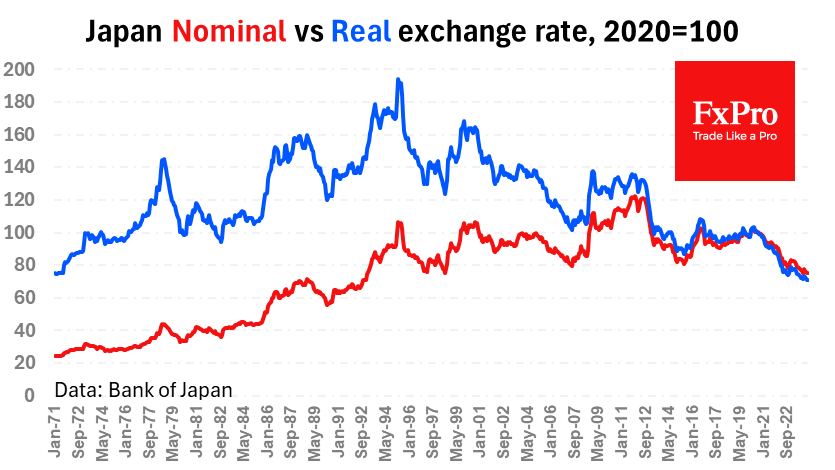

The nominal effective exchange rate of the yen has retreated to its lowest levels since the 1990s. The yen reversal to growth in 1997 on the back of crises in developing countries was at about the same level. The pressures of the global financial crisis in 2007 turned the yen up 5% higher. Thus, the current levels are not an anomaly, and the yen has fluctuated near these levels many times in the last 34 years.

A weakening yen potentially poses risks of inflating inflation. We have noticed that the government and CB intervene in the market when year-to-year changes approach 20%. USDJPY is adding 17% y/y, EURJPY is up 13% y/y. This is quite a lot but allows the authorities not to share the passions of the financial media and traders.

Yen weakening is measured by historical standards, not allowing to talk about a currency shock for the economy.

As the nearest turning points, we can consider the area of 160 on USDJPY – the point of market reversal in April 1990. EURJPY has a similar point near 170. At these levels, intervention cannot be certain. The chance of intervention in free forex pricing will clearly increase if the yen collapses rather than slowly creeping there.

The FxPro Analyst Team