Expect a triple hit from the Dollar

October 26, 2021 @ 14:13 +03:00

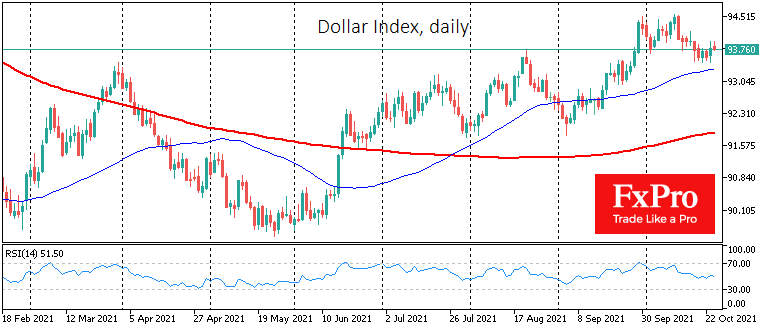

The US Dollar has been losing ground for the past two weeks, but it looks more like a tactical retreat before a new surge, while significant near-term factors are playing on the Dollar’s side.

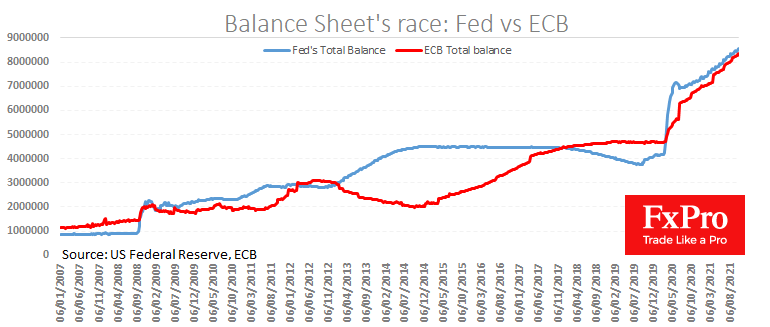

US central bank officials are bolstering markets with confidence that a reduction in Fed balance sheet purchases will be announced in November. This flow of new dollar liquidity will become smaller and be further reduced month by month, drying up entirely by July next year. At least, that is the market expectation and Fed’s forecasts.

This factor began to be incorporated into market quotes in June. Still, its influence weakened due to debates over the US government debt ceiling, which restricted the US Treasury.

The Treasury could not borrow money in the markets and only spent the liquidity reserves, almost completely depleting them when the legislators raised the debt ceiling.

Surprisingly, the Finance Ministry acted very cautiously last week, borrowing only $44bn on markets. This modest appetite can probably be explained by the reluctance to sell new securities into the market when the existing ones are falling in price as their yields rise.

Observers point out that the Fed helped the Treasury as much as it could by buying more than 80 billion in Treasuries off the market, which kept their price down by exhausting two-thirds of the whole month purchase limit on the balance sheet.

But the Ministry of Finance still has to enter the markets to borrow in the coming weeks. This promises to push US government bond yields to new year highs for long-term securities and multi-year highs for shorter issues.

Huge auctions and rising yields will suck liquidity from other markets, causing capital to flow into dollars.

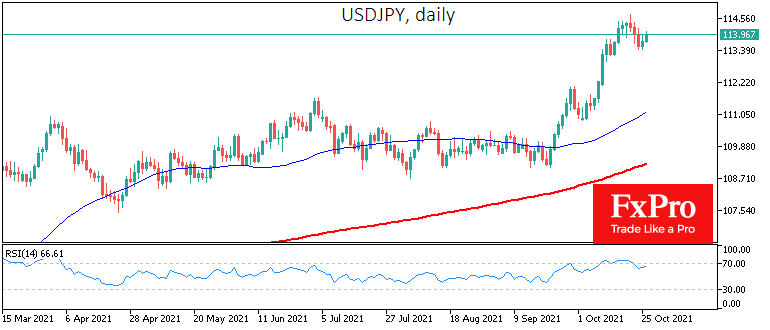

Meanwhile, in some other markets, central banks continue to be persuaded that their policies are soft. The People’s Bank of China is injecting increasing amounts of liquidity to keep domestic yields from rising. The Bank of Japan lowered its consumer price forecast this morning, contrary to 13-year highs in wholesale price inflation, without giving any signals that it might abandon its crisis tools in the foreseeable future. After a short recovery late last week, the yen returned to the slide and traded above 114 in USDJPY.

On balance, we have the action of the US Treasury and the Fed both reducing the supply of new dollars into the financial system, while the major global central banks predominantly avoid policy tightening. All three factors work together, creating a near-perfect basis for the Dollar to rise in the coming weeks.

The FxPro Analyst Team