Evercore Leans Positive, With Five Reasons Stocks Haven’t Tanked

May 18, 2020 @ 14:48 +03:00

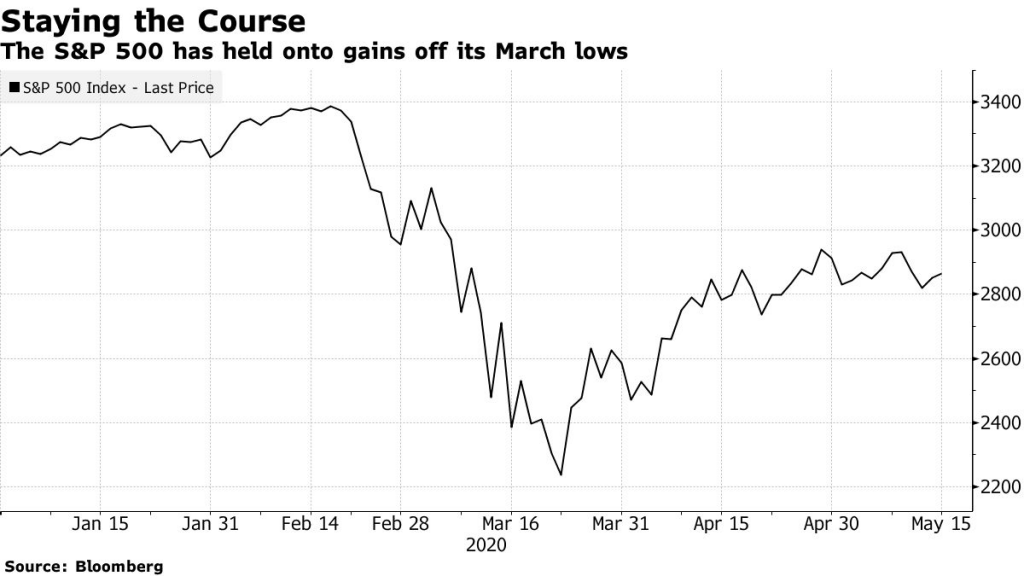

The apparent dichotomy between bad news on the economy and resilience in the stock market isn’t such a mystery for the strategists at Evercore ISI, who remain unswayed by dark warnings from Wall Street heavyweights.

The key counterpoint has been moves to reopen businesses around the world.

-S&P 500 valuation isn’t extreme; stocks look cheap on the basis of price-to-cashflow and price-to-cash return — which aims to show the ability of a company to use its capital to generate cash flow — even if not by price-to-earnings. “Unlike other periods, the valuation measure you choose could severely skew your view of market-risk reward”

-Estimated Covid-19 transmission rates in the U.S. are declining, new case growth is trending lower across Europe and Asia, and there are “few signs of virus resurgence”

-Some experts have become more positive on vaccines and the potential for them to start arriving later this year; “people trading on cluster headlines may be missing the progress on this front”

-Evercore analyst Josh Schimmer is “confident the vaccines can arrive by year-end — if we need them,” he wrote in a note Saturday

-Hedge funds are net short and only 24% of investors in Evercore’s latest survey see the S&P 500’s next 10% move as up

-Economic data from China and credit-card spending are improving

Evercore Leans Positive, With Five Reasons Stocks Haven’t Tanked, Bloomberg, May 18