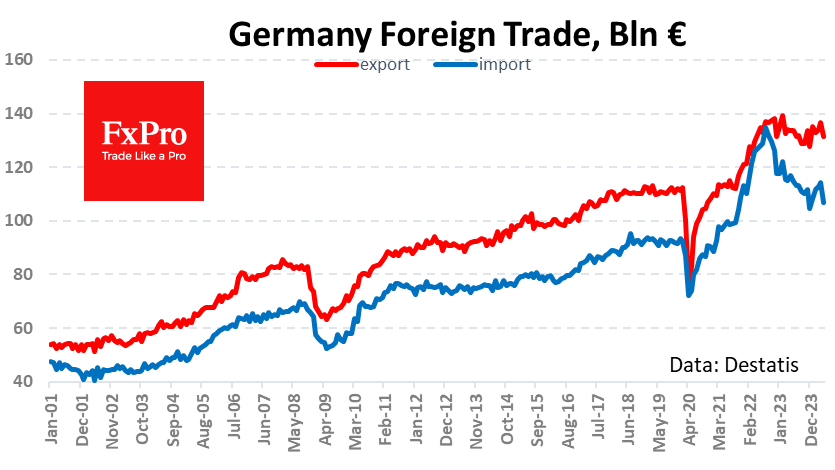

Germany recorded a second-record foreign trade surplus of 24.9bn in May, second only to January this year. The figures are noticeably better than the previous 22.2bn and the expected 19.9bn. This is moderately positive news for the euro as it reflects stronger net demand for the euro.

However, worryingly, the surplus widened as the 6.6% fall in imports exceeded the 3.6% decline in exports. The dynamics of imports in Germany are closely linked to manufacturing activity, and both are at their peak. In turn, this could have a negative impact on the economy in the coming months, outweighing the initial positivity for the single currency by a margin.

The bad news for the Eurozone did stop here. The Sentix Investor Confidence index plummeted to -7.3 after just a month in positive territory (it was 0.3 in June). The index initially fell into deep negative territory in March 2022 but has been in positive territory since last October. The latest downward reversal shows how fragile economic growth is in the eurozone.

The FxPro Analyst Team