Euro: slightly better than USD but worse than its European peers

October 22, 2021 @ 18:29 +03:00

Business activity in the eurozone avoided a sharp decline despite a surge in energy prices in September and October. As a result, the euro is developing a rebound from multi-month lows against the franc and pound. There is also a notable buying interest in EURUSD after a dip to 1.1620 with the start of active trading in Europe.

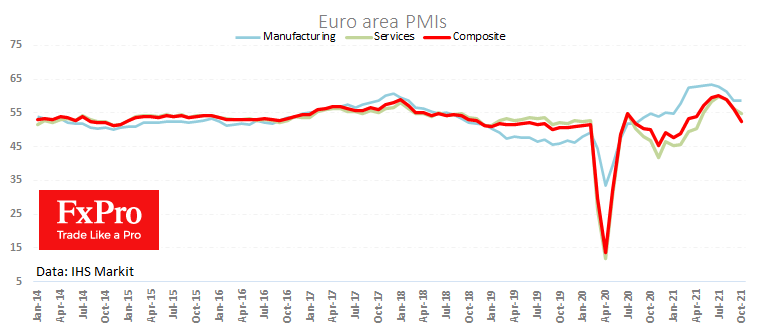

Preliminary PMI estimates indicate that the eurozone economic recovery is cooling down, but not as fast as might have been expected amid energy price spikes and frightening headlines about production stoppages.

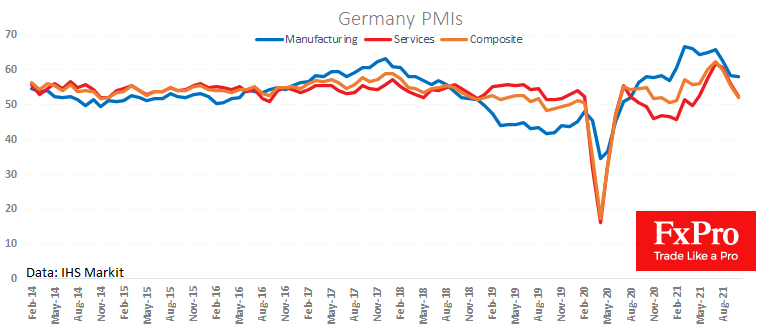

The growth rate of the eurozone’s manufacturing engine, Germany, is exceeding expectations, with the corresponding PMI falling from 58.4 to 58.2 against expectations of 56.4, pulling up the euro zone-wide index. Despite the downturn, these levels are well above the 10-year average of 52.4.

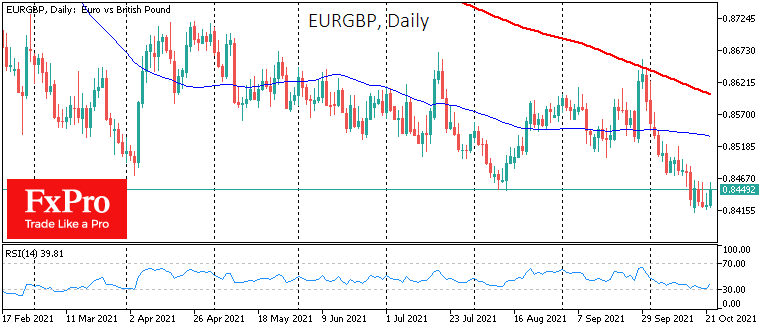

The single currency has added just under 1% in 10 days of dollar retreat but is amongst the stragglers in the major crosses. Against the pound, the single currency is adding 0.2% today, having retreated from its lowest levels since February 2020. Early in the day, the EURCHF slipped to 1.0660, which is also the area of last year’s lows.

More recently, the pair bounced strongly from 1.07, making us suspect the Swiss National Bank’s interventions. However, the big question is whether the euro will be able to develop a sustained rebound from the current multi-month lows vs its main peers amid the ECB’s decidedly more dovish rhetoric compared to the Fed and the Bank of England.

It may well be that the euro’s rebound is only supported by Friday’s profit-taking on the technical oversold Euro but does not break the overall bearish picture. It will be possible to talk about breaking the downtrend in EURUSD only if the pair consolidates above 1.1700 and above 0.8500 against the pound.

The FxPro Analyst Team