Euro ready to go off the cliff

April 14, 2022 @ 17:20 +03:00

Today’s meeting did not satisfy the expectation that the ECB could lend a helping hand to the euro by keeping it from plunging off a cliff. Europe has refused to accelerate monetary policy normalisation as most G7 countries have.

Currency market dynamics are always a comparison of relative strength. With a bigger blow to the economy from the events in Ukraine and no less of a problem with inflation, the single currency risks remain under pressure due to a rapidly widening gap in interest rates in the euro area and beyond.

The European Central Bank kept key interest rates unchanged and noted that the asset purchase programme would be scaled back and completed in the third quarter. Market participants expected these announcements.

The focus of market participants was on comments about further plans. And they are relatively mild, considering the external environment. The Fed is preparing the ground for a 50-point rate hike and the start of QE. The Bank of Canada and RBNZ already did so yesterday. The Bank of England and the Bank of Korea have returned rates to pre-pandemic levels.

In the meantime, the ECB is putting out a very sluggish plan: complete purchases in the third quarter, only then start to raise rates, and it will reinvest payments “long after the start” of tightening.

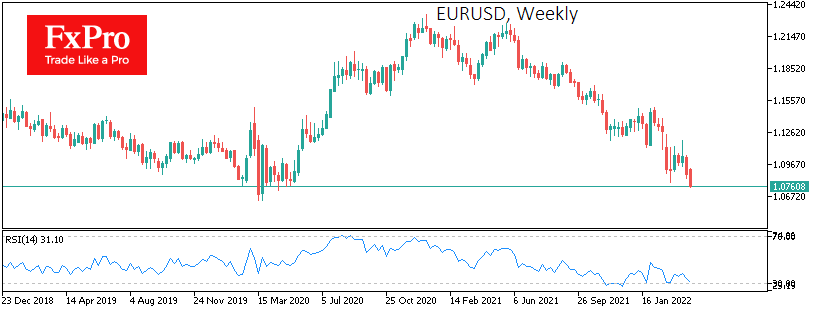

The EURUSD is hovering below 1.0800 on the two-year low. But the euro has an increased chance of being sent into free fall. Much like the Japanese currency, which reached 20-year lows against the Dollar earlier today, the Bank of Japan is still not convinced that deflation has been defeated.

The same can be said for the EURGBP pair, which has returned to levels below 0.8300 this week and is trading at arm’s length from 6-year lows.

The FxPro Analyst Team