Euro rallies on Franco-German relief fund hopes; Goldman ends short position

May 20, 2020 @ 14:10 +03:00

The euro has rallied this week after a landmark coronavirus relief fund proposed by France and Germany provided a “meaningful positive surprise” to expectations for the common currency, according to Goldman Sachs.

As of Wednesday morning, the euro was trading at around $1.0942, up another 0.2% early in the European trading session, having started the week around the $1.08 mark. Despite tumbling in mid-March from above $1.14 to below $1.07, the common currency is up almost 1.5% over the past three months.

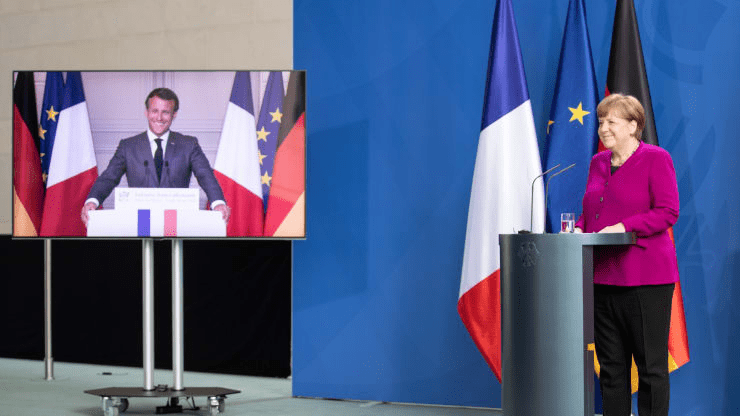

It comes after Europe’s two largest economies announced Monday that they would ask the European Commission, the executive branch of the European Union, to raise 500 billion euro ($545 billion) in public markets, to be distributed to countries most impacted by the coronavirus pandemic.

Goldman Economist George Cole said in a note Tuesday that the size of the relief fund was “relatively small in macroeconomic terms.” However, he flagged that the fact that it was agreed proactively in the absence of market pressure is likely to justify a relief rally in EMU (European Economic and Monetary Union) states’ sovereign bond spreads.

The sovereign bond spread is the difference between the yield on a country’s bond issue and the yield on a comparable bond issued by a benchmark country, such as Germany as Europe’s largest economy.

These spreads had been widening, but Goldman analysts anticipate that the Franco-German proposals will “short-circuit” that and bring spreads narrower. This relief rally in spreads implies that, should the proposal go through, these sovereign bonds are more likely to offer sufficient compensation relative to the risk.

This narrowing of EMU spreads and easing of market pressure is what prompted Goldman analysts to close their short position on the euro against the traditional safe haven Swiss franc on Monday for a loss of around 0.8%.

Euro rallies on Franco-German relief fund hopes; Goldman ends short position