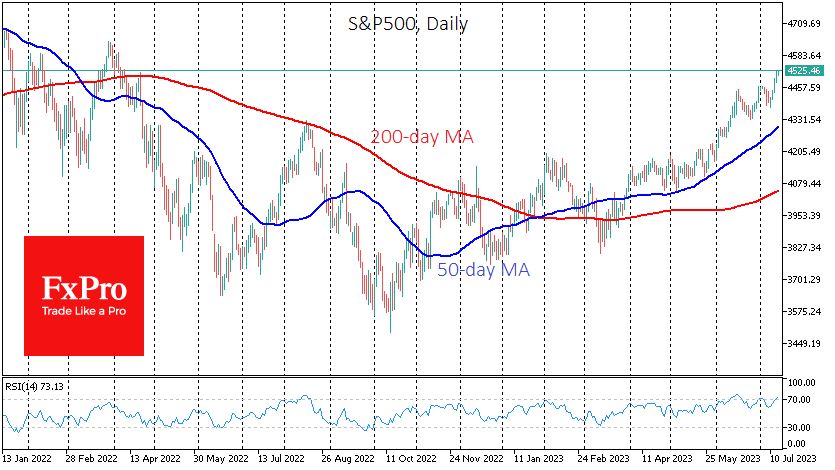

After the impressive rally in equity indices in the first half of the year, it was logical to expect a correction or a summer lull. But we only got a brief pause, and the rally resumed this week with renewed vigour thanks to a double economic surprise. However, markets appear to have gone too far.

The US benchmark S&P500 crossed 4,500 on Thursday evening, its highest level since April last year, and is up more than 3.2% from its lows at the start of the week. The market’s upward amplitude is not abnormal but becomes so when monetary and fiscal policy and some economic indicators are considered.

The Fed funds rate is now at its highest level since 2007 and has arrived at the fastest speed in 40 years. Financial conditions in the real economy will only tighten in the coming months, even if the central bank doesn’t raise rates further. But it promises to raise them.

In their speeches, FOMC members continue to talk of two more 25-basis-point hikes before the end of the year and a continued intention to keep rates at their highs for an extended period. According to the FedWatch tool, interest rate futures now indicate a 20% chance of two hikes before the end of the year and only an 8% chance that the rate will be above current levels in a year. In other words, the Fed should move quickly from rapid hikes to cuts.

The Fed has made sharp reversals before, but always after a spike in market volatility. Steadily rising stock prices are more likely to spur the central bank to tighten monetary policy further, including accelerating asset sales from its balance sheet.

Since the end of March, the market has accelerated higher while the Fed’s balance sheet has begun to shrink again, showing accelerated convergence. But stocks and bonds are substitutes in a resource-constrained environment, and investors choose one or the other.

There’s something else too. Over the past month and a half, the US Treasury has issued $735bn of bonds on a net basis, on top of the $89bn that the Fed has sold to the market. The market has swallowed it all and has been accepting ever-lower yields for the past week reflected in rising prices.

Such a sharp contrast between the dynamics of equities and the Fed’s balance sheet raises questions about the sustainability of equity positions. Still, active speculators should not forget the advice of Keynes, one of the first macroeconomists to become a trader: “Markets can remain irrational longer than you can remain solvent”.

The FxPro Analyst Team