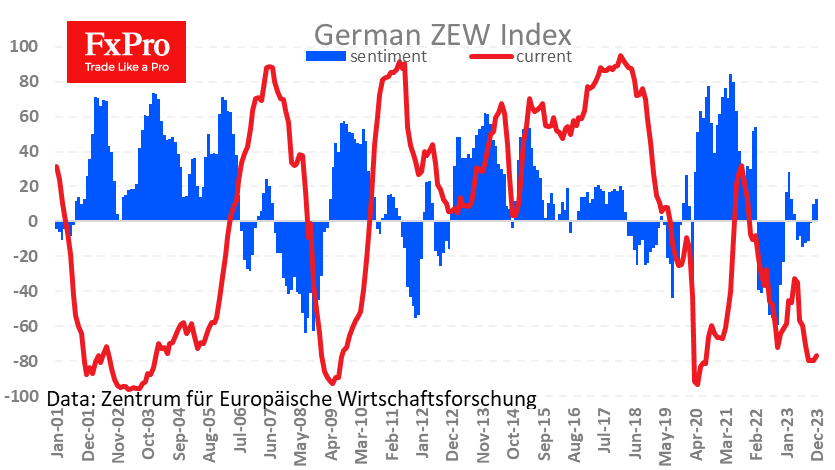

Fresh business sentiment assessments from ZEW saw the sentiment index rise from 9.8 to 12.8, a positive surprise for analysts who had anticipated a slight decline to 9.6. The current optimism level is the highest since March this year but below the long-term average of 20.8.

Some signs of a reversal can be found in the assessment of current conditions. The corresponding index has risen to -77.1 after -79.9 and -79.8 in the past two months. This is a retreat from a cyclical low but is still at the depressed-low levels seen in early 2020 and 2009.

Wholesale prices fell 0.2% in November after falling 0.7% a month earlier and -3.6% y/y. Negative annual inflation rates over the past eight months have helped to reduce inflationary pressures, allowing the ECB to turn its rhetoric towards greater softness and willingness to cut rates earlier than previously expected.

The FxPro Analyst Team