Economic optimism causes dollar retreat

November 23, 2020 @ 13:04 +03:00

The dollar index remains close to an important support line of around 92, where it is pressed by rising demand for risk assets. In addition to the widespread expectations of speedy vaccine use, investors are paying attention to noticeably stronger macroeconomic indicators than expected. This improves demand for the currencies of these countries, the latest examples being the New Zealand and Australian dollars as well as the British pound.

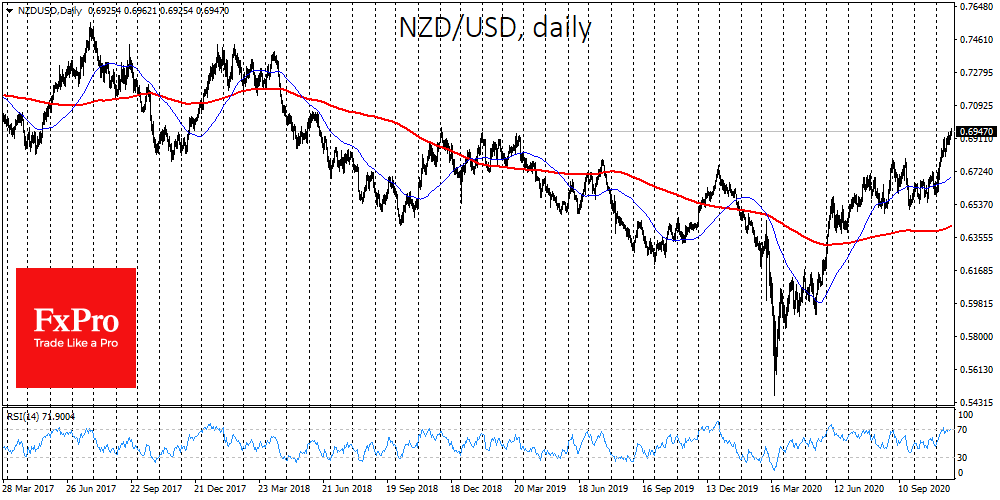

NZDUSD reached a 2-year high of 0.6961 after the release of solid retail sales data. The area of 0.68-0.70 has been an important area of a tug-of-war between bulls and bears for the last five years. The pair’s ability to reach above 0.70 sustainably opens up a growth potential of 0.74-0.75 – the area of its peak in 2016-2018. New Zealand avoided a second coronavirus wave, recording single cases of new infections and a total of 2030 (1953 cured). Thus, the economic damage to the economy promises to be minimal, and the recovery rapid.

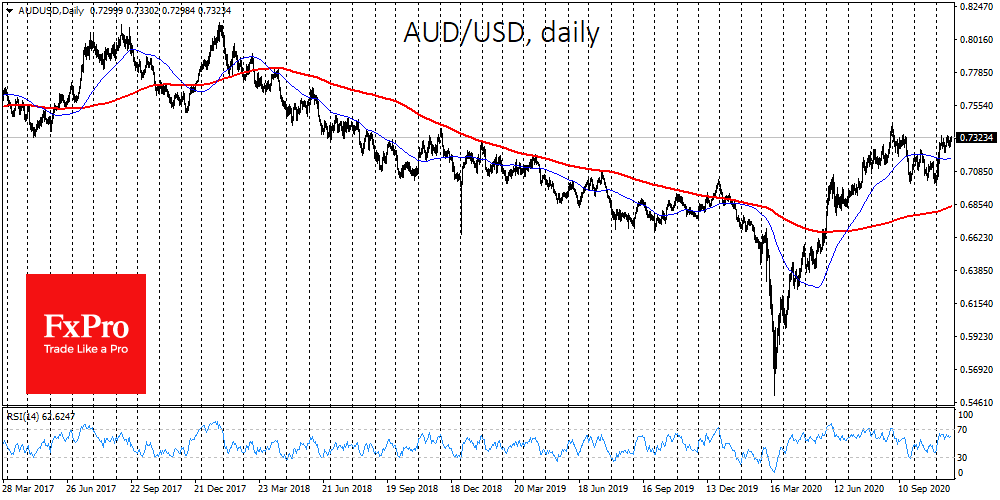

This is roughly the same in Australia, which has consistently enjoyed strong business data. In addition to the very strong employment growth data published last week, CBA’s strong reports on the manufacturing and service sectors have been added. This analogue of the PMI was at its highest levels for many years. AUDUSD is trampling around 0.73. Its growth has been more restrained in recent days than that of its neighbour, but it is also in an area of peaks in the last two years.

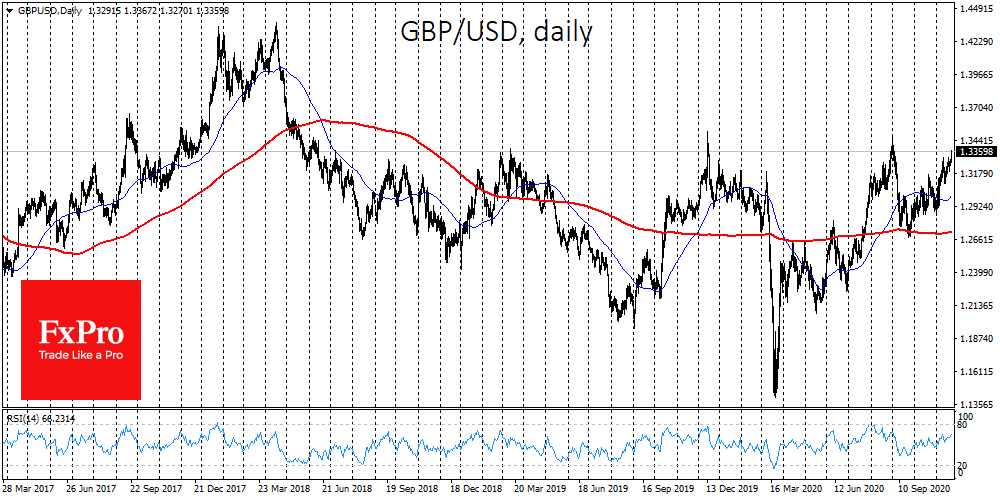

GBPUSD exceeded 1.3380 this morning. There has been some encouraging news in the UK recently, however, the overall situation is hard to call unambiguously optimistic. Friday’s retail sales figures have significantly exceeded expectations, supporting the growth of the pound. Besides, there is news of progress in UK trade negotiations with other countries, which also reduces the risk of adverse consequences and leaving the EU without agreements with major trading partners.

GBPUSD has tried unsuccessfully to gain a foothold above 1.33 for the last two and a half years. The pullback after the September setback has been relatively modest, tuning it to strengthen pair purchasing, which increases the chances of success for the bulls this time.

All three currencies – NZD, AUD, GBP – have a positive correlation with risk demand, highlighting the common denominator is a weakening dollar. If one of these three is successful, it is almost inevitable that some other major pairs will also go to test ranges against the dollar.

The situation against the dollar is exacerbated by the fact that the US is currently discussing a support package of only $500 billion instead of 2 trillion. For markets, this means less US government bond issuance and less demand for dollars from abroad, which shifts the balance of power against the US currency and will tend to further weaken it in the coming weeks.

The FxPro Analyst Team