ECB react to bond yields jump by faster money-printing and may hurt Euro

March 11, 2021 @ 17:40 +03:00

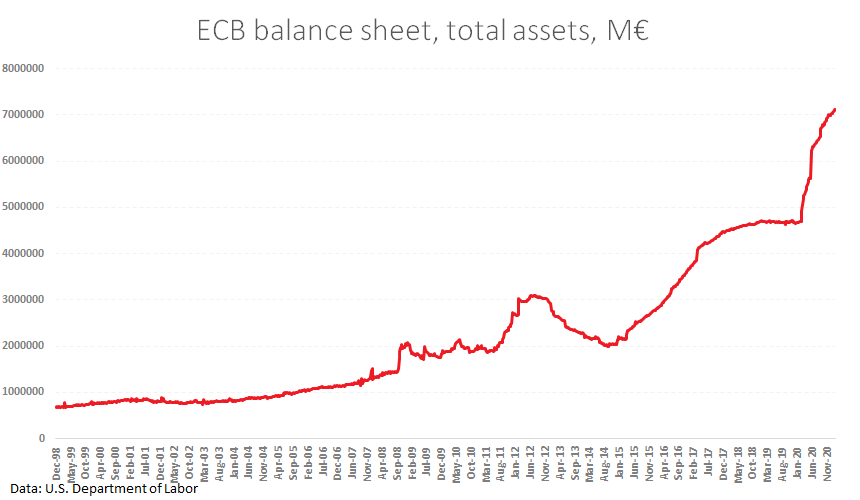

The ECB kept key interest rates unchanged but announced a “significantly higher pace” for the pandemic emergency purchase programme. Meanwhile, it has not expanded the total size of the envelope, keeping it at 1.85 trillion.

Today’s monetary policy statement reflected the ECB’s reaction to rising bond yields. Although the euro first moved somewhat up from 1.1940 to 1.1970 (now it rolled back to 1.1950), we see it as moderately negative news for the euro.

The ECB quickly reacted to rising bond yields, increasing the package’s size in January and today signalled faster money-printing.

This willingness to maintain the status quo in the markets will find an outlet in a weaker euro against the dollar and pound unless their central banks follow the European Central Bank’s lead.

We will not have to wait long for the Fed’s response, as the next meeting is less than a week away. That will determine the extent of central bank policy divergence.

The FxPro Analyst Team