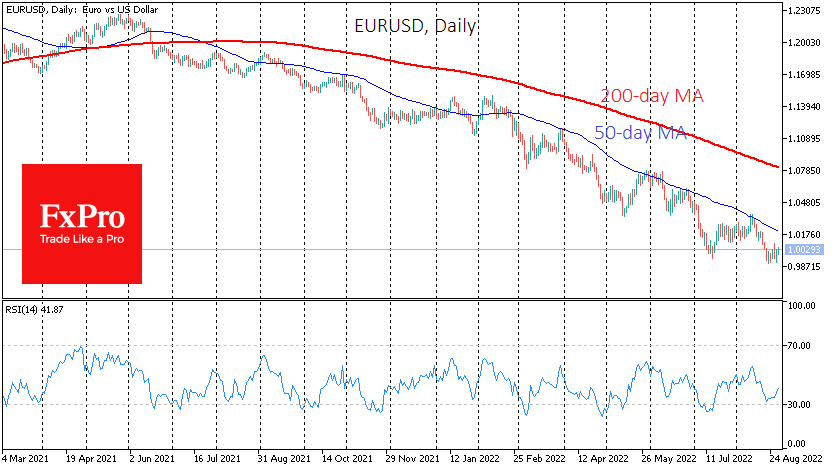

The fall in the single European currency has paused after briefly touching the 0.99 level earlier this month. As in July, the momentum of the EURUSD decline has sparked a resurgence of verbal interventions. Judging by the tone of recent comments, the ECB is reassuring the markets that it is soon ready to raise rates more aggressively.

This sentiment supports interest in the single currency hovering around parity with the dollar. We recently heard from Lane that September would mark the start of a new phase of ECB policy.

As clearly as possible for central bankers, Rehn and Kazaks say that euro weakness worries the regulator and will influence the next rate decision.

The euro’s 15% fall against the dollar over the past 12 months is an additional pro-inflationary factor on top of skyrocketing energy prices, broken supply chains and a tight labour market.

With such a macroeconomic backdrop, it is not surprising that central bankers talk about the need to “take the pain” of policy tightening to suppress price increases and, more importantly, reverse inflation expectations.

The good news for the euro is that it responds well to the reassurances and threats from central bank officials. That was difficult for the BoJ to achieve earlier this year. At the same time, it is worth realising that verbal interventions in this situation can only buy a little time. Very soon, the ECB will confirm its intentions by effectively tightening monetary policy.

The fact is that not only energy prices are now at stake but also the credibility of the debt securities of smaller Eurozone countries. Last month, the ECB was forced to launch a sophisticated mechanism to hold down bond spreads of core and peripheral euro-region countries. The widening of spreads was another signal of a loss of confidence.

Uncontrolled current-level depreciation could permanently undermine the euro’s status as a reserve currency, quickly translating into higher debt-servicing costs. The debt problem is bad news for the euro. History is also not on the side of the buyers right now. In previous episodes of overcoming parity, it was not a turning point but only a temporary stopgap. Fundamentals are also on the bears’ side for now. Because, despite the attention on the euro exchange rate, the ECB is moving slower than Fed in policy normalisation and much further away from the point where policy becomes neutral.

The FxPro Analyst Team